Posted on

April 5, 2019

by

Fabrizio Zenone

Federal housing agency says more than 10 per cent of Metro Vancouver home purchases would fall within price cap

The new First Time Home Buyer Incentive (FTHBI) announced in the recent Federal Budget has come under fire for its income and purchase price caps, prompting Canada Mortgage and Housing Corporation (CMHC) to release a statement defending the program April 4.

The program will offer first-time buyers an interest-free loan of up to five per cent of the purchase price of a resale home, or 10 per cent of a new home. The loan will come in the form of a shared-equity mortgage with CMHC and is available to households with an annual income of up to $120,000. The incentive is applicable on mortgages of up to four times the applicants’ household income, resulting in a maximum home purchase price of around $505,000, assuming a five per cent deposit and a $480,000 mortgage value plus CMHC loan.

Critics have suggested that the purchase price cap means those who most need the program, in expensive cities such as Vancouver and Toronto, will get the least use of the initiative, as average home prices in those areas are far higher than the incentive’s maximum purchase price.

However, CMHC disputed this argument Thursday, saying that there are many options for starter homes in both cities under $505,000.

The CMHC wrote, “Despite the income and borrowing limits, we are confident this program can work in all markets, including Vancouver and Toronto… This program applies up to a house price of $505,000, assuming a five per cent down payment. However, we shouldn’t confuse market average prices ($1 million in Vancouver and $770,000 in Toronto) with starter home prices.

“It may not be a condo in Yaletown or a house in Riverdale, but there are options in both metropolitan areas to accommodate this program. In fact, around 23 per cent of transactions in Toronto are for homes under $500,000 and 10 per cent in Vancouver. It is very difficult to estimate the demand for the incentive; however, based on last year’s activity — more than 2,000 home buyers in Toronto would have been eligible for the FTHBI and over 1,000 in Greater Vancouver.”

The CMHC also denied that the incentive would have an inflationary effect on home prices, saying that the program had been calculated to avoid this.

The statement said, “We have carefully targeted the FTHBI to help younger Canadians having trouble affording home ownership. The program is capped at $1.25 billion over three years... We do not expect the FTHBI’s inflation effect to be beyond a maximum of 0.2-0.4 per cent.”

The housing agency added that suggestions the federal government should have reduced the mortgage stress test or increased mortgage amortization periods to 30 years would result in much more inflation.

“Limiting house price inflation will keep housing more affordable, more so than some of the other suggested policy and regulatory changes. For example, a reduction of one per cent in the mortgage insurance stress test or an extended amortization limit of 30 years would have added to indebtedness and resulted in house price inflation of five to six times more than this maximum.”

However, all these arguments may be moot if the Liberal Party of Canada is not re-elected in October’s federal election.

CMHC concluded its statement with, “We will release more details as soon as we can and we expect the program to be operational this September.” But the agency also said that there were still a lot of details to work out, and offered no guarantee of a September launch date.

Elizabeth May, federal Green Party leader, told media on Budget day, “[New homebuyer incentives are] a big present that the Liberals have wrapped up for us, but it all requires new legislation, so we won’t get to unwrap that gift unless the Liberals are re-elected.”

Posted on

April 4, 2019

by

Fabrizio Zenone

:max_bytes(150000):strip_icc():format(webp)/cutting-the-grass-with-environmentally-friendly-push-mower--winnipeg--manitoba-597292006-5a80c9c83128340036ff8133.jpg)

First the bad news: if you neglect spring lawn care (and related concerns about your mower), you could end up paying for it the rest of the year. Now the good news: the chores required of you in spring don't entail nearly the amount of work that you'll have to invest in mowing alone throughout the summer months.

In fact, you might need to implement only about half of the following ten tips for spring lawn care, depending upon your unique circumstances. Furthermore, there are a few instances below that the task in question is better performed as part of your fall lawn care if you can wait that long.

Raking

Raking will be your first task of spring lawn care. You're likely saying, "But we already raked leaves in the fall!" Sorry, but raking is for more than just removing leaves: it's for controlling thatch, too. A thatch build-up of more than 1/2 inch is considered excessive.

Thatch is the reason why it's recommended that, when you rake leaves in the fall, you make an effort to rake deeply. Don't just skim the surface so as merely to remove the leaves. A deep raking will remove thatch, too, allowing you to kill two birds with one stone. Even if you followed this advice in fall, a spring raking is still recommended as it will remove grass blades that died over the winter -- dead blades that are just waiting to become thatch.

But there's often another good reason for a spring raking. As you survey your lawn in spring, see if there are any matted patches, in which the grass blades are all stuck together. This can be caused by a disease known as "snow mold." New grass may have difficulty penetrating these matted patches. But raking will be sufficient to solve this problem.

When you perform any of these spring lawn care tasks will depend upon the climate of your region. But Mother Nature provides obvious cues in some cases. For instance, when you're pretty sure the snow season (if you have one) is over in your region, begin raking. Applying pre-emergent herbicides (see Tip #6) should be done sometime between the time the local forsythia bushes stop blooming and the time the local lilac bushes begin blooming.

Check for Compaction

If your lawn is subject to high levels of traffic year after year, it may eventually start to show signs of decline. In such cases, your lawn is probably suffering from compacted soil. For instance, the presence of moss signals compaction (among other things). You can get rid of it, but successful eradication begins with the recognition that moss shouldn't be treated as "just another weed."

Lawn aeration is the remedy for compaction. The good news is that lawn aerators can be rented at your local rental center. The bad news is that the experts recommend postponing lawn aeration until fall. But if during your "spring lawn checkup," you become aware of compaction, at least you can plan on setting aside some time in the fall to take care of it.

Liming

Besides compaction, the presence of moss plants also signals acidity. But grass likes a neutral pH. You can solve this problem by liming your soil. But don't expect a quick fix: the effects of liming are slow to take place.

But first, send a soil sample to your local county extension to determine the extent of your soil's acidity. The county extension will also be able to advise you on how much lime per square foot you'll need. Apply the lime using a fertilizer spreader.

But if your lawn has been doing fine and shows no signs of suffering from acidity, don't apply lime. Liming is only a corrective measure, not a preventive measure. A soil that is too alkaline will also cause your lawn problems, so too much lime is as bad as not enough.

Overseeding

Is your lawn riddled with bare patches due to dog spots, heavy traffic, or neglect? If so, you may need to apply grass seed to fill in those bare patches. This solution is known as "overseeding lawns." Apply a slow-release nitrogen fertilizer when you overseed. Five weeks after the grass germinates, apply quick-release nitrogen fertilizer.

However, spring isn't the very best time for overseeding lawns. Fall is the preferred time when the new grass won't have to compete with crabgrass, which is killed off by autumn frosts. So postpone overseeding until fall, unless your situation is dire.

Fertilize

Lawns can be fertilized organically by using compost and mulching mowers. But for those who prefer chemical fertilizers, Scotts provides a schedule for fertilizing lawns. Many experts, however, recommend a lighter feeding in spring and a heavier one in late fall for the types of lawn grasses known as "cool-season grasses." Too much fertilizer in spring can lead to disease and weed problems. And if you have, indeed, already fertilized in late fall, your lawn is still "digesting" that fertilizer in spring.

For those who prefer weed-free lawns, spring grass care is as much about weed prevention as it is about fostering healthy lawn growth. Novices are often surprised to learn that not all lawn weeds are battled in the same manner. Depending upon whether a weed is an annual or perennial, you will use a preemergent herbicide or a post-emergent herbicide against it (although landscapers commonly use both preemergent and post-emergent crabgrass killers -- an indication of how tough that weed is to battle).

Apply Preemergent Herbicides

If you know that you have a problem with the annual weed, crabgrass, then fertilization in spring should go hand in hand with the application of preemergent herbicides. As their name suggests, preemergent herbicides address weed control, not after the fact, but before their seedlings can even emerge. Preemergent herbicides accomplish this by forming something of a "shield" that inhibits seed germination. Don't undertake core aeration after applying preemergent herbicides: to do so would be to "puncture" this shield, thereby decreasing its effectiveness.

Crabgrass begins its assault on lawns in spring when its seeds germinate. Overseeding should be carried out in autumn, rather than spring, based in part on the threat posed by a spring crabgrass invasion. "So why not just begin by killing the crabgrass first with a pre-emergent herbicide?" perhaps you ask. Well, the trouble is that most preemergent herbicides work against not only weed seeds, but grass seeds, as well!

You can appreciate the dilemma here. Overseeding is incompatible with the application of most preemergent herbicides. Faced with competition from crabgrass in spring, you may find it difficult to establish your new grass. So while it's still possible to overseed in spring, it's simply easier to do so in fall. There will be no competition from crabgrass then because the fall frosts kill off crabgrass.

If you must overseed in the spring, look for a product called, "Tupersan." Unlike other preemergent herbicides, Tupersan will not damage germinating lawn grass seed. But if you're committed to staying away from chemicals altogether in your spring grass care, postpone overseeding till fall.

Apply Postemergent Herbicides (Or Pull Weeds)

Keep an eye out for the emergence of the perennial weed, dandelion during the spring season, unless you find the presence of their cheerful yellow flowers in your lawn desirable. At the very least, you'll want to snap off their flower stems before they produce seed. If you're more ambitious, you can dig them out by the roots. Spraying dandelion weeds with post-emergent herbicides is more effective in fall than in spring. If you do choose to spray, you must select an herbicide for broadleaf weeds.

Besides proper spring grass care, there's more you need to do to get ready for a summer filled with lawn mowing. Don't neglect preparations concerning the lawn mower itself.

No other power equipment is as intimately associated with and essential to landscaping as is the lawn mower. You need to have one that will consistently get the job done without any hassles throughout the lawn mowing season. And you should also know how to use one to your best advantage. Consequently, the final three of my ten tips focus on caring for, selecting and using these machines.

Tune-Up Existing Lawn Mowers

Mowing the lawn all summer can be tiring enough, right? Why make it more difficult on yourself by putting up with a lawnmower that doesn't start up immediately? When your unit is stubborn about starting up, that can be a sign that it needs a tuneup.

Although it’s often possible to get by without one, it is recommended that you have a mower tuneup each year. Don't put it off till summer or pay someone else to do it. Learn how to tune one up yourself.

Buy a New Lawn Mower

Or perhaps you're fed up with your old lawnmower? Is it time for a change? Research and decide on which type is best suited to your own unique landscaping needs.

Review Lawn Mowing Strategies

"What's there to know about lawn mowing?" perhaps you ask. "You just push the lawn mower, and it cuts the grass, right?" At the most basic level, Yes. And if lawn mowing is merely a mindless chore that you perform to satisfy other people (and you don't care much about the health of your grass), then you needn't know any more about it.

However, if you do care about the health of your grass, there's a bit more to lawn mowing than just keeping your grass short enough to prevent the neighborhood from thinking your house has been abandoned. Spring is a good time to learn (or review) lawn mowing strategies–before it becomes so hot outside that it's hard to think!

Posted on

March 7, 2019

by

Fabrizio Zenone

Few things are quite as painful to look at as grout that's chipping away around your otherwise perfect tiles. The only thing arguably worse is having to actually call someone in to fix it for you, so if you're willing to get your hands a little dirty, it's really a project you can DIY. But how?

Lowe's suggests starting by making sure you are choosing the correct materials. To begin, you'll need to determine which type of grout you need—sanded, unsanded, acrylic, or epoxy grout. In short, sanded grout should be used if the space between tiles is more than 1/8 of an inch (but not on metal, glass, or marble tiles), and unsanded grout should be used if the width is less than 1/8 of an inch.

Once you've determined the type of grout you'll be using, follow these steps, according to Lowe's:

1) Clean the area where the grout is broken with a 1-to-1 vinegar and water mixture.

2) Remove damaged grout and debris with a grout saw. Be extra careful with this step as you can scratch or chip tiles during the scraping process.

3) Follow the instructions on the grout to create the mixture.

4) Spread the grout and completely fill the cracks using a grout float. It is best to do this at an angle, then smooth over the grout with a wet finger.

5) Using a grout sponge, get rid of any excess.

6) Allow the grout to set based on the instructions with which it came. Note: Depending on the type of grout you use there may be slight differences. Be sure to follow directions carefully!

7) Use a haze remover to get rid of residue, if needed.

Posted on

February 28, 2019

by

Fabrizio Zenone

Way out here on the Best Coast, it’s easy to think of ourselves living in something of a separated-off bubble – and that when it comes to real estate, the bubble looks to be deflating.

But the fact is that B.C.’s major cities are among many around the globe that are currently experiencing a real estate market slowdown.

Most of us are aware that the Greater Toronto Area is also in the property doldrums, with sales in 2018 down 18 per cent year over year (not as steep as Metro Vancouver’s 31.6 per cent annual decline). The average 2018 home resale price in our country’s biggest city is also down 4.7 per cent over the previous year.

But what about the rest of the world?

Property markets in major global centres are also on the slide, most notably in pricey cities such as Hong Kong, Shanghai, Beijing, Singapore, London and Sydney.

In Hong Kong and mainland China’s biggest cities, prices are steadily declining, with prices in Beijing and Shanghai around five per cent off their peak of around six months ago – largely due to a slowing Chinese economy affected by trade wars with the U.S. In London and across the U.K., uncertainty over Brexit has sidelined homebuyers, and London property prices have fallen for two consecutive years. In Australia’s biggest city, unsustainably high prices along with a pullback in demand from mainland Chinese buyers have combined to drag real estate markets down over the past year, with prices down more than 11 per cent in Sydney, according to CoreLogic. Plus, Singapore’s prices have been hit by increased taxation and new mortgage rules.

Bloomberg published a fascinating story on this topic Jan. 3, and identified that even as each slowing market has its own set of characteristics, most of them also have a few factors in common:

1) Tougher government regulations on mortgages and finances – these range from the mortgage stress test in Canada, to stricter loan-to-value ratios in Singapore, to limits on how much money can leave mainland China.

2) Rising interest rates – Canada is far from the only country to see increased borrowing costs. The Bank of England (led by former Bank of Canada governor Mark Carney) has been similarly making incremental hikes over the past year or so, and rates in Singapore have risen several times over the past year, with more hikes predicted in 2019. Australia’s Reserve Bank, however, has maintained record-low rates – and prices are still dropping there too.

3) Unpredictable stock markets – with the world’s markets fluctuating wildly, much of which uncertainty is linked to U.S./China trade wars, investors around the globe are unsure where things will land and are keeping a low profile.

4) Diminishing demand from China – property markets in most Pacific Rim cities, whether in North America, Australasia or Asia, are affected by the wobbling Chinese economy and a tightening of rules on how much money is allowed to flow out of mainland China.

Bloomberg cites an April 2018 International Monetary Fund study, which issued a warning on the effect of simultaneous global real estate market corrections. The IMF wrote that such a phenomenon could lead to “financial and macroeconomic instability.”

However, a glimmer of hope for global economic stability was issued today (Jan. 4) as major stock markets made a sudden recovery on the news of renewed trade talks between China and the U.S.

It may seem like some consolation that B.C. cities are not alone in their housing market decline – after all, it makes for a more level playing field, globally speaking. But from a macro-economic viewpoint, it’s not such a good thing.

Posted on

February 12, 2019

by

fabrizio zenone

According to the city, 4,979 Vancouver property owners have yet to declare their property’s status. Photo Dan Toulgoet

Ninety-seven per cent of Vancouver property owners can pat themselves on the back for making their Empty Homes Tax declaration by the Feb. 4 deadline.

As for the remaining three per cent — or 4,979 property owners — they can make a late declaration, says the city.

In a press release, the city reminds residents that those who do not declare will have their properties deemed vacant by the city, and be subject to the tax at a rate of one per cent of the property’s 2018 assessed taxable value. They will also be charged a $250 bylaw fine.

This year ― the second year of Vancouver’s Empty Homes Tax ― the city is making late declarations available. Once the property owner pays the $250 late fee (or disputes the ticket), they can make their online declaration. Bylaw tickets can be paid at vancouver.ca/pay-ticket.

Once a late declaration of occupied or exempt has been submitted, the tax bill will be cancelled.

How to submit a late declaration for Vancouver’s Empty Homes Tax:

- One declaration per property is required. You can declare in a number of ways, including:

- Online at vancouver.ca/eht-declare. The online declaration process is simple and takes most people only a few minutes to complete. Online chat with an EHT representative is available.

- In person at City Hall. Residential property owners may visit City Hall where staff will be available to assist them with online declarations. City Hall regular hours are 8:30 a.m. to 5 p.m.

- Over the phone by calling 3-1-1. Residential property owners who need assistance making their online declaration can call 3-1-1 between 7 a.m. and 10 p.m. daily (outside Vancouver: 604-873-7000) and speak to a citizen service representative. Translation services are also available at 3-1-1.

Payment of the Empty Homes Tax levy is due by April 12, 2019 or an additional five per cent penalty will be applied. If payment is not made by Dec.31, 2019, the amount will be added to your property tax bill.

The City of Vancouver’s Empty Homes Tax is separate from the provincial government’s Speculation and Vacancy Tax; inquiries regarding the province’s tax may be directed to gov.bc.ca/spectax or by calling 1-833-554-2323.

Posted on

February 5, 2019

by

fabrizio zenone

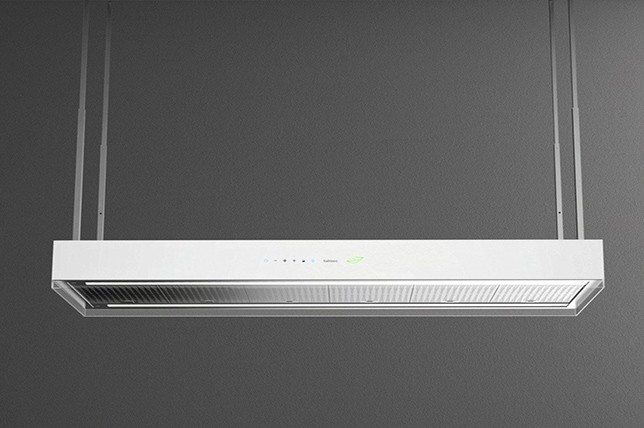

For those considering an elevated kitchen renovation—or really any renovation—these ten questions will make your life—and your interior designer and contractor’s life—easier. By having these ten questions answered before you call your contractor, you’ll be able to have a more productive, streamlined experience.

- What is your goal?

Are you planning to sell your home in the next few years? Are you intending to upgrade your home for that sale? Or are you simply seeking to make the best of your kitchen decor?

- How long do you plan to live in your home?

If you see yourself living there for only a few years, you should probably consider a different type of renovation, something that’s maybe not as expensive or something that’s more timeless and traditional in your favored aesthetic. However, if you’re going to be living there longer, then naturally you’ll be spending a bit more to design something that sings to you.

- Do you have children?

If you do, where are you going to store everything out of their reach? Resilient, easy-to-clean materials, are ideal for kid-friendly kitchen ideas.

- Do you have allergies and health issues?

If someone in your family suffers from asthma or other breathing issues, consult your contractor and have them avoid high-gloss lacquers and urea and phenol formaldehyde.

- Will you be residing in your home during your renovation?

If so, keep in mind that it will add to the lead time and construction duration, as well as adding to the level of protection and cleanliness that needs to be maintained during the renovation process.

- What is your budget?

Answer this question for yourself so you can better understand what amount of money you can spend comfortably. It’s crucial to be honest with the experts you hire about what that number really is.

- What have people in similar homes accomplished?

Getting to the answer of ‘Can I do it?’ is helpful in beginning the process.

- What can you remove to open up your kitchen?

Ask yourself and your contractor about exploring every possibility to make the best use of your kitchen remodel.

- What’s behind those walls?

You do need to keep in mind that every kitchen has concealed utility risers that will ultimately limit the amount of room you have to work with.

- When can you get started?

Because a well-planned project is a well-executed project, take your time to properly plan every move you make during the kitchen renovation process.

Posted on

February 5, 2019

by

fabrizio zenone

Posted on

February 5, 2019

by

fabrizio zenone

METRO VANCOUVER MARKET HIGHLIGHTS

JANUARY 2019

DETACHED

- Active Listings:

- 4,974

- Sales: 339

- Benchmark Price:

- $1,453,400

- Avg. Days On Market:

- 64

TOWNHOUSE

- Active Listings:

- 1,719

- Sales:

- 205

- Benchmark Price:

- $800,600

- Avg. Days On Market:

- 52

APARTMENT

- Active Listings:

- 4,115

- Sales:

- 559

- Benchmark Price:

- $658,600

- Avg. Days On Market:

- 47

January 2019

1,103

Sold

(-39.3%)

Residential property sales in Metro Vancouver

Home listings continue to increase across all housing categories in the Metro Vancouver* housing market while home buyer activity remains below historical averages.

The Real Estate Board of Greater Vancouver (REBGV) reports that residential home sales in the region totalled 1,103 in January 2019, a 39.3 per cent decrease from the 1,818 sales recorded in January 2018, and a 2.9 per cent increase from the 1,072 homes sold in December 2018.

Last month’s sales were 36.3 per cent below the 10-year January sales average and were the lowest January-sales total since 2009.

"REALTORS® are seeing more traffic at open houses compared to recent months, however, buyers are choosing to remain in a holding pattern for the time being."

Phil Moore, REBGV president

There were 4,848 detached, attached and apartment homes newly listed for sale on the Multiple Listing Service® (MLS®) in Metro Vancouver in January 2019. This represents a 27.7 per cent increase compared to the 3,796 homes listed in January 2018 and a 244.6 per cent increase compared to the 1,407 homes listed in December 2018.

The total number of homes currently listed for sale on the MLS® system in Metro Vancouver is 10,808, a 55.6 per cent increase compared to January 2018 (6,947) and a 5.2 per cent increase compared to December 2018 (10,275).

For all property types, the sales-to-active listings ratio for January 2019 is 10.2 per cent. By property type, the ratio is 6.8 per cent for detached homes, 11.9 per cent for townhomes, and 13.6 per cent for condominiums.

Sales-to-active listings ratio - January 2019

Total 10.2%

Generally, analysts say that downward pressure on home prices occurs when the ratio dips below the 12 per cent mark for a sustained period, while home prices often experience upward pressure when it surpasses 20 per cent over several months.

“Home prices have edged down across all home types in the region over the last seven months,” Moore said.

The MLS® Home Price Index composite benchmark price for all residential homes in Metro Vancouver is currently $1,019,600. This represents a 4.5 per cent decrease over January 2018, and a 7.2 per cent decrease over the past six months.

“Economic fundamentals underpinning our market for home buyers and sellers remain strong. Today’s market conditions are largely the result of the mortgage stress test that the federal government imposed at the beginning of last year,” Moore said. “This measure, coupled with an increase in mortgage rates, took away as much as 25 per cent of purchasing power from many home buyers trying to enter the market.”

Sales of detached homes in January 2019 reached 339, a 30.4 per cent decrease from the 487 detached sales recorded in January 2018. The benchmark price for detached homes is $1,453,400. This represents a 9.1 per cent decrease from January 2018, and an 8.3 per cent decrease over the past six months.

Sales of apartment homes reached 559 in January 2019, a 44.8 per cent decrease compared to the 1,012 sales in January 2018. The benchmark price of an apartment property is $658,600. This represents a 1.7 per cent decrease from January 2018, and a 6.6 per cent decrease over the past six months.

Attached home sales in January 2019 totalled 205, a 35.7 per cent decrease compared to the 319 sales in January 2018. The benchmark price of an attached unit is $800,600. This represents a 0.5 per cent decrease from January 2018, and a 6.2 per cent decrease over the past six months.

* Areas covered by the Real Estate Board of Greater Vancouver include: Whistler, Sunshine Coast, Squamish, West Vancouver, North Vancouver, Vancouver, Burnaby, New Westminster, Richmond, Port Moody, Port Coquitlam, Coquitlam, Pitt Meadows, Maple Ridge, and South Delta.

Posted on

January 28, 2019

by

fabrizio zenone

Concrete planters are a great addition to any home. Concrete is just as useful and versatile today as it was when the Romans discovered how to make it 2000 years ago. Early masons used the humble mix of cement, sand, stone, and water to build impressive structures such as the Pantheon (A.D. 126), which is still in use as a house of worship. With its stout granite columns and massive concrete dome, the Pantheon gives new meaning to "built to last."

1How to Build a Concrete Planter

2Form and Cast

Screw together the inner and outer forms. Coat the exterior of the inner form with glue, and cover the surface with aluminum foil. Do the same for the inside face of the outer form. Spray cooking oil on the foil surfaces.

Place the inner form, top-down, on the mounting board. Screw through the bottom of the board into the form's cross supports. Place the outer form over the inner one, and use angle brackets to secure the outer form to the mounting board.

Empty an 80-pound bag of Quikrete Countertop Mix into a wheelbarrow. Add about 5 ounces of buff liquid cement color to 1 gallon of water in a bucket. Add the tinted water to the powdered concrete a couple of cups at a time until the mixture is malleable but not runny.

Pour the concrete into the form. Repeatedly plunge a scrap-wood stick into the concrete to consolidate it. Overfill the form, then run an oscillating sander (without sandpaper) over the entire form to vibrate out voids. Strike off excess concrete. Form drain holes by pushing two dowels coated with petroleum jelly through the concrete.

3Strip the Outer Form

After letting the concrete set for 18 hours, unscrew and disassemble the outer form. Grab and twist out the dowels with pliers.

Posted on

January 28, 2019

by

fabrizio zenone

Councillor Jean Swanson says rents will keep rising unless vacancy control and rent freezes are implemented

We've all heard Vancouver house prices described as "bubbly" – but are rents about to do the same thing?

Rental prices are expected to go up by an average of 7 per cent in 2018, despite the provincial rent control caps now in force, according to a Rentals.ca forecast issued January 21.

That’s the third-steepest predicted rise in the country, after Toronto (where rents are forecast to increase 11 per cent) and Ottawa (9 per cent), said the national report.

Local housing experts interviewed by the rental website for its annual forecast said that it’s going to become increasingly difficult to find an affordable rental apartment in Vancouver. This is despite new measures that tie the annual rental increase for a sitting tenant to inflation, which is 2.5 per cent in 2019.

“The dynamic is shifting away from ‘bubbly’ house prices to ‘bubbly’ rental rates,” wrote report author Ben Myers, president of Bullpen Research & Consulting Inc..

“With expanded rent control implemented in 2017, tenants are incentivized to stay in their current home. This is not ideal, as some people may choose not to take a job in another part of the city because of higher rents. As fewer units are turned over, there is less supply, and rental rates [on any newly advertised units] increase further.”

Councillor Colleen Hardwick told the rental listing website that Vancouver’s ultra-tight rental market is having a serious social impact. “Seniors are being forced out of their homes. There are rental evictions; aggressive buyouts.” She said that rising interest rates, housing price stabilization, flipping properties, and newer rentals replacing older buildings are the key issues to watch in 2019.

Jean Swanson, City of Vancouver councillor, said she is also worried about affordability. “The issue is scarcity; the vacancy rate is low,” she said. “Owners are buying out buildings at inflated prices, and without vacancy control they are buying out the tenants… the older the building, the more vulnerable the tenants.“

Swanson believes that vacancy control, which would prevent landlords from raising rents between tenants, along with a rent freeze that would prevent yearly increases, would solve the problem.

The idea of vacancy control has seen a major backlash from the development community. The Urban Development Institute has claimed it would be the “death knell”of purpose-built rental supply and would do more harm than good.

B.C.’s Rental Housing Task Force seemed to agree, rejecting vacancy control as one of its 28 recent recommendations in the overhaul of the Residential Tenancy Act.

Posted on

January 15, 2019

by

fabrizio zenone

Many first-time buyers are taking a wait-and-see approach,

in case home prices drop further - is that the best strategy?

Recently I was asked to guest live on CityTV’s BT Vancouver morning news show to recap a range of industry predictions for real estate in 2019. During the interview, I was asked what strategy first-time buyers should adopt if they’re hoping to get into the market but are waiting to see what will happen.

This question, of trying to time the market, is one that comes up time and time again — no matter whether we’re in a rising market, in a down market, or in a steady market (which, in fact, we have now, in terms of prices for entry-level homes). People have a terror of buying a home at the “peak” of the market, or at another point where prices will drop after they’ve bought the home — but I don’t think this is something to fear.

To make my interests clear: I’m not a real estate agent or adviser, I’m a writer and editor who specializes in real estate and spends her days analyzing and reporting on market statistics. I have nothing to gain from advising anyone to buy homes, and I am not paid by anyone other than the media company for which I work, which gives me free rein to share my views as I see fit. I own a condo (my home) plus a long-term investment studio in Vancouver. I don’t offer advice to try to buoy the market, but simply because I’ve been lucky enough to get into this position (largely by ignoring those who told me not to buy yet) and I want to share what I’ve learned.

The very smart senior analyst of the Real Estate Investment Network, Don Campbell, once said to me, “The past two decades are littered with the bones of those who stayed on the sidelines of the real estate market.” That phrase stayed with me, as I see it all the time — friends in their 50s and 60s who are still renting, and will now likely pay rent throughout their retirement years. They all tell me, “I wish I’d bought when I was younger. Homes seemed soexpensive, even back then - but that’s nothing compared with what they are now.”

Exactly. The £182,000 (British pounds) I paid for my tiny first flat in South London, a 50-minute commute from work, seemed astronomical 15 years ago. I could only raise a 5 per cent down payment and take out an interest-only mortgage. And everyone told me not to buy it, as “we’re at the peak of the market.” They said the same thing when I moved up to a larger place even further out of town, for £240,000, in 2008. That really was the then-peak of the market, as immediately after I bought it, the recession hit and its value dropped by 15 per cent.

But no matter. I was still above water, as my mortgage was still only £175,000, and over the next few years the value more than recovered. I sold it for £280K in 2014, and that’s how I had a down payment to buy a condo in downtown

Vancouver.

That’s how real estate works. There is no price “peak,” only a fluctuating, but generally upward, line. If you’re looking at holding onto a home for a reasonable length of time, if you can afford the mortgage and if you have a decent down payment, just go for it — trying to time the market is a fool’s errand. Those price predictions I spoke about last week differ considerably, so nobody really knows what will happen this year, or next. Sure, the general consensus is that here in Metro Vancouver, average home prices might dip by a couple of per cent this year. But even if that happens, interest rates are rising. So a lower average home price a) doesn’t mean the specific home you want to buy will be any cheaper and b) even if it is, it doesn’t mean it’s more affordable, if mortgage costs are going up.

The only buyers I’d recommend to wait are speculators looking for a quick flip. For everyone else, if you hold on to your home for long enough, it will always end up higher than you bought it for.

Now we are facing an influx of one million additional people in Metro Vancouver by 2050. Political migration, climate migration, our relatively stable economy, our Pacific Rim position, and many other factors will, in my opinion, mean that even if prices dip in the next year or so, they will at some point over the next decade exceed their previous peak. And by the time we get to 2050, I predict that today’s Millennials will be wishing they had bought 30 years previously, when the average cost of a condo was “only” $600,000 and they could’ve gotten a great little pad in Surrey for $250K.

You really don’t want to be on the wrong side of the price rises that could be ahead of us over the next 10 or 20 years. So if you're lucky enough to be able to buy a home — whichever location you can afford, and in whatever size home — just go for it. I did, and I’ve never regretted it.

Article by Joannah Connolly / Vancouver Courier

Posted on

December 21, 2018

by

fabrizio zenone

The Canadian housing market reflected a lot of restraint and not much growth in 2018. Even so, there are reasons to be optimistic when looking forward to the new year ahead. Check out these forecasts for 2019: The Canadian housing market reflected a lot of restraint and not much growth in 2018. Even so, there are reasons to be optimistic when looking forward to the new year ahead. Check out these forecasts for 2019:

The Mortgage Stress Test Affected Overall Sales Numbers

There were a number of policy changes that took place in 2018, all of which likely had some effect on the real estate sector in Canada. Some point to the mortgage stress test, which was initiated in January 2018, as having a major impact.

The stress test requires homebuyers to qualify for mortgages at higher rates than the contracted mortgage rate. The purpose is simple: to determine if the borrowers have the ability to continue making mortgage payments if interest rates increase.

In late 2017, some buyers kicked into overdrive as they searched for a home, in an effort to avoid having to pass the mortgage stress test at the beginning of 2018. In fact, the Canadian Real Estate Association reported more than 46,000 homes sold throughout Canada in December 2017. The following month, after stress tests were put in place, housing transactions dropped by 14%.

A Lackluster 2018 Points toward a Stronger Market in 2019

It’s true that 2018 was rather lacklustre in terms of home sales. However, there was also no major economic shock. This leads experts to believe that the Canadian real estate market is likely to remain steady, at a minimum, or even experience a slight growth in 2019.

The Canada Mortgage and Housing Corporation (CMHC) believes that price tags on properties will move in accordance with the economy. That is, so long as there is stable growth in income, jobs, and population, the housing market should move in step.

The specific prediction of the CMHC is that sales through the MLS will be lower than 500,000 in 2019, which is in line with 2017 but lower than 2016. They also believe that the average home price across the country will not hit $525,000. Of course, regional real estate markets will have differing forecasts.

Local Markets Impacted by Changing Mortgage Regulations

Taking a step closer and looking at specific housing markets throughout Canada paints a consistent picture. Toronto real estate was slower in 2018 compared to both 2017 and 2016. In fact, all of Ontario showed a slowdown in housing transactions–and flattening of sales prices–since the second quarter of 2017. This slowdown was likely a result of the new taxes imposed on foreign homebuyers in the province. The CMHC believes that the urban housing markets throughout Ontario will recover from a slump in 2018, which will be caused mainly by predicted job growth and in-migration.

They expect that B.C.’s housing market will moderate even more than it has, considering the fact that there’s been an economic contraction and more people moving out than moving in. For example, Vancouver real estate prices have been growing, but at a slower rate, since new transaction taxes were imposed on foreign buyers. In fact, there were 35% fewer Vancouver home sales in October 2018 compared to October 2017.

Calgary real estate resales were down by 9% in October 2018 compared to the year before, and the composite housing price index dropped 2.6% in October year-over-year. This was the only large housing market to experience a decline in the composite housing price index for the month of October.

Some expect real estate in the Prairies to continue to moderate, in part because of the heavy reliance on fossil fuels and other extractive industries. Others, however, believe these housing markets are actually ripe for growth.

Montreal real estate is expected to benefit from a projected boost in foreign buyers in the upcoming year, thanks to the fact that it has not joined Toronto and Vancouver in imposing taxes on foreign buyers. It is also likely that this means rental vacancy rates in Montreal are going to drop, due to a larger demand caused by a strong economy and in-migration.

Finally, the CMHC has predicted that the number of units sold and the prices of existing homes in Nova Scotia will both be on the rise. However, this will be an anomaly in Atlantic Canada, which will continue to struggle due to lower population growth.

Posted on

December 21, 2018

by

fabrizio zenone

Taxes

Vancouverites have railed against property taxes for decades and made no exemption in 2018. With so many levies to choose from, it’s tough to pick just one. The dour joke that B.C. stands for “Bring Cash” applies no longer to just the high cost of living but also to the rising cost of acquiring and holding real estate in the province – if you can afford it.

The fun kicked off in July 2016 with the announcement of a snap tax on foreign nationals buying residential property, and ramped up in the 2018 provincial budget with news that the property transfer tax on foreign nationals would be expanded to more areas and a vacancy and speculation tax would be introduced. That tax followed in the steps of a similar initiative by the City of Vancouver, which claimed 25,502 homes in the city were vacant but levied the tax against only 2,538 homeowners this year.

Commercial property owners, particular neighbourhood retail, have also been hit hard. City councillors long opposed Walmart’s debut in the city, citing concerns about its impact on local businesses. But property taxes have one-upped Walmart, pushing many long-standing businesses from premises (now subject to redevelopment with higher and better uses) along Broadway, Main Street and Commercial Drive to points east and south.

Interest rates

When the year began, rising interest rates were expected to have an effect on both commercial and residential property sales, not to mention prices. Together with a new federal mortgage stress test, increases to interest rates muted residential purchases this year and seem set to continue to do so.

The impact on non-residential deals was muted, however, thanks to a shortage of opportunities.

This has been particularly true of industrial properties, where deal-making remains strong – a situation that Avison Young expects to continue through the first half of 2020. While interest rates have increased, supply hasn’t, meaning there’s still a price to be paid for assets. Those who want space are willing and able to pay, even if it means buying strata space.

“Vacancy remains tight and financing is easily available to industrial owner-occupiers,” Avison Young said of the strata market, noting that the first half of the year saw $449 million invested in industrial properties worth more than $5 million, while those worth less than $5 million (mostly strata properties) attracted $301 million.

While capitalization rates are inching up, vacancy rates may well prove a better indicator of market strength so long as investors are willing to pay. This isn’t the case for residential, with many homebuilders bracing for a slowdown while acknowledging, as one remarked at a year-end party, “Vancouver’s had a good run.”

In the field

B.C.’s Agricultural Land Commission turned 45 in 2018, and the province marked the occasion by asking people how to revitalize it and the properties it oversees.

While the Agricultural Land Reserve (ALR) is generally considered a fact of life, several pronouncements have – depending on your perspective – either reinforced the ALR’s sacred-cow status or created confusion about what exactly might be allowed. The latter was illustrated by Abbotsford’s decision to pause a planning process that sought, among other things, to crack down on non-compliant use of properties within the reserve.

Meanwhile, initiatives around the province have sought to limit the kind of production that takes place in the ALR. Richmond failed to rein in monster homes within the ALR, then sought to limit the use of slab-on-grade construction with a view to limiting cannabis cultivation. While the province has no problem with food production and has been cool with ginseng and echinacea in the past, cannabis has drawn censure and an order-in-council limiting production to soil-based systems.

Having eliminated the two-zone ALR and strengthened regulations governing activities within the ALR in 2018 (including mandating limits on residential construction), B.C. Agriculture Minister Lana Popham promises to change up governance of the reserve in 2019.

With development land in short supply, the changes mean the ALR will continue to make headlines.

Posted on

November 29, 2018

by

fab zenone

Every need and lifestyle is addressed in a variety of floorplans, each with 9-foot ceilings and featuring plenty of natural light and space. Once you have found an ideal layout, personalize it for your tastes by selecting from two beautiful colour palettes. Interior living seamlessly transitions to private outdoor decks, where views and fresh air are always enjoyable. Appreciate the art of entertaining or a quiet afternoon watching Netflix – homes are designed for all elements of life.

Posted on

November 26, 2018

by

ROSA ZENONE

Come to Place des Arts’ free, all-ages celebration of cultural diversity and discover how our cultural traditions and customs are entwined over the holiday season.

Over a warm cup of tea, learn how to tell your story and hear the inspiring stories of others in a storytelling tea salon, led by First Nations spoken word artist Molly Billows. Make lanterns inspired by those from the main cultural groups that populate Coquitlam: China, Iran, Korea and the West, and enjoy live music performances and other fun surprises.

Admission is free. All ages welcome.

Visit Place des Arts for more information.

‘Tis the season!

Join us for the annual Skate with Santa on Dec. 16 at the Poirier Sport and Leisure Complex. The big man in red will be donning a pair of skates for some fun, on-ice activities from 11-12:30 p.m., 12:45-2:15 p.m. and 2:30-4 p.m. There will be free hot chocolate to warm up with after!

Note: There will be a family rate for Skate with Santa. Rentals are not included.

Celebrate the holidays at Glen Pine Pavilion with festive music and performances by Glen Pine's talented entertainers.

Date: Sunday, Dec. 16, 2018

Time: 1:30-3:30 p.m.

Price: Tickets: $8 (children six and under $3)

All ages event

Join us for a family afternoon with Santa! We'll keep you busy with crafts, snacks, story time and great opportunities with Santa, as well as lots of active play with your family. | Register Now

Date: Sunday, Dec. 16

Time: 2 – 4 p.m. OR 4 – 6 p.m.

Cost: $2.00/person

Location: Poirier Community Centre

Let's fill Lafarge Lake with the sound of music! Sing along with caroling groups as you stroll around the lake.

At 7:30 p.m. everyone will stop where they are and join in a community sing-a-long of Jingle Bells. Rain or shine!

Learn about more pop-up events with Coquitlam's Park Spark staff and volunteer team at coquitlam.ca/parkspark.

Coquitlam Heritage welcomes you to join us in celebrating our 2018-2019 exhibit Heirlooms & Treasures. Music, performance and food along with exhibit tours will highlight the traditions, customs and objects that our community holds dear. No Registration Required.

Posted on

November 15, 2018

by

Fabrizio Zenone

Every house will acquire holes in the walls throughout its life. Whether it is a small hole from a painting you re-located or a larger hole from an accident, fixing a hole in the wall is a relatively straightforward process. Here are seven steps to fix a hole in the wall in your house.

Step 1 - Prep Surface

Start by cleaning around the hole and making sure any loose drywall or paint is removed. You want to get the surface around the hole as smooth as possible so that the patching compound will get the best adhesion. Sand around the perimeter of the hole to remove as much excess drywall as possible.

Step 2 - Patch Small Holes

For holes smaller than 1/2 inch in diameter, you do not need a bridging compound. You can simply fill the hole with some spackle or plaster and use your putty knife to smooth out. Once the compound is dry, sand it and repeat the process until the wall is smooth. After that, you can use a texture spray to mimic the existing wall and paint.

Step 3 - Add Hole Patch

If the hole is larger than 1/2 inch, then you need a hole patch to smooth out the surface. Start by placing the patch over the hole to determine the size of the patch. You want to leave 1/2 inch extra all the way around the hole. Once the patch has been cut, take off the backing paper and install the patch over the hole. Try and get the edges of the patch as smooth as possible before proceeding. If the adhesive fails to stick, use a wet sponge to apply the patch. You can also use some patching compound around the edges to secure it in place.

Step 4 - Apply Patching Compound

With the patch in place, add the patching compound with your putty knife. Start by applying the compound around the edges of the patch, working your way inward. Ensure the patch is completely covered with the compound before stopping. Most compounds will dry a different color when they are fully dry. If the hole is fairly large, you may need to work in sections, allowing each one to partially dry before continuing. This will help keep the mesh in place and provide extra support for the middle of the patch. Try and get the compound as smooth as possible before it dries as this will cut down on sanding.

Step 5 - Sand

You should let the compound dry overnight before sanding. When you start sanding, do not stop until the edges of the patch are in line with the outer wall. This will help blend everything together when you paint. Once the sanding is complete, clean the area with a damp cloth and let it dry for about 15 minutes. While the wall dries, clean up any access dust or particles that were created during the sanding process.

Step 6 - Prep for Paint

Depending on the style of the wall, you should use a textured spray prior to painting. The spray should match the existing wall’s texture, so you may need to adjust the thickness until you get it just right. Once the texture is on, allow it to dry overnight before painting.

Step 7 - Paint

Getting the paint to match might be the hardest part of fixing a hole in the wall. If you do not have the original paint, you can remove a few chips and take it down to your local hardware store to get it matched. Once you have the right paint, simply paint over the patched surfaced and allow it to dry for around six hours. If you do not want to go through the trouble of matching the paint, you can repaint the entire wall a new color.

Posted on

November 6, 2018

by

Fabrizio Zenone

Home sale activity across Metro Vancouver* remained below long-term historical averages in October.

The Real Estate Board of Greater Vancouver (REBGV) reports that residential home sales in the region totalled 1,966 in October 2018, a 34.9 per cent decrease from the 3,022 sales recorded in October 2017, and a 23.3 per cent increase compared to September 2018 when 1,595 homes sold.

Last month’s sales were 26.8 per cent below the 10-year October sales average.

“The supply of homes for sale today is beginning to return to levels that we haven’t seen in our market in about four years,” Phil Moore, REBGV president said. “For home buyers, this means you have more selection to choose from. For sellers, it means your home may face more competition, from other listings, in the marketplace.”

There were 4,873 detached, attached and apartment homes newly listed for sale on the Multiple Listing Service® (MLS®) in Metro Vancouver in October 2018. This represents a 7.4 per cent increase compared to the 4,539 homes listed in October 2017 and a 7.7 per cent decrease compared to September 2018 when 5,279 homes were listed.

The total number of homes currently listed for sale on the MLS® system in Metro Vancouver is 12,984, a 42.1 per cent increase compared to October 2017 (9,137) and a 0.8 per cent decrease compared to September 2018 (13,084).

For all property types, the sales-to-active listings ratio for October 2018 is 15.1 per cent. By property type, the ratio is 10.3 per cent for detached homes, 17.3 per cent for townhomes, and 20.6 per cent for condominiums.

Generally, analysts say that downward pressure on home prices occurs when the ratio dips below the 12 per cent mark for a sustained period, while home prices often experience upward pressure when it surpasses 20 per cent over several months.

“Home prices have edged down between three and five per cent, depending on housing type, in our region since June,” said Moore. “This is providing a little relief for those looking to buy compared to the all-time highs we’ve experienced over the last year.”

The MLS® Home Price Index composite benchmark price for all residential homes in Metro Vancouver is currently $1,062,100. This represents a one per cent increase over October 2017 and a 3.3 per cent decrease over the last three months.

Sales of detached homes in October 2018 reached 637, a 32.2 per cent decrease from the 940 detached sales recorded in October 2017. The benchmark price for detached properties is $1,524,000. This represents a 5.1 per cent decrease from October 2017 and a 3.9 per cent decrease over the last three months.

Sales of apartments reached 985 in October 2018, a 35.7 per cent decrease compared to the 1,532 sales in October 2017. The benchmark price of an apartment property is $683,500. This represents a 5.8 per cent increase from October 2017 and a 3.1 per cent decrease over the last three months.

Attached homes sales in October 2018 totalled 344, a 37.5 per cent decrease compared to the 550 sales in October 2017. The benchmark price of an attached home is $829,200. This represents a 4.4 per cent increase from October 2017 and a 2.8 per cent decrease over the last three months.

Posted on

October 30, 2018

by

Fabrizio Zenone

Every month, the Cit compiles a list of Vancouver’s must-see events. This makes it easy to ensure that you’re always around ‘n about town experiencing all that Vancouver has to offer. We’ve drawn from various sources to make this calendar your monthly go-to list for all things Vancouver. The Cit is pleased to release the November edition of your Vancouver Social Calendar. As always, if you have an event you’d like us to include, share.

Attend a Remembrance Day ceremony

When: Tuesday, November 11

Where: Multiple locations around Vancouver

Celebrities 30 Year Anniversary

When: Friday, November 7 to Monday, November 10

Where: Celebrities Nightclub

What: The historical & diverse nightlife destination celebrates 30 years with special sets from Hot Since 82, Amine Edge & Dance and a Vogue Charity Event featuring NYC Legend MikeQ

Website: www.thisisblueprint.com (Full release: http://thisisblueprint.com/news/nightclubs/celebrities-celebrates-30-years-strong)

Twitter: @celebrities_van #CELEBS30YR

Hastings Park Winter Farmers’ Market

When: Running until November 30, Sundays from 10 a.m. to 2 p.m.

Where: PNE Fairgrounds

What: Shop local winter produce + artisan prepared foods + local crafts + enjoy hot food trucks

Website

11th Annual Downtown Eastside Heart of the City Festival

When: Running until November 9

What: Over 90 arts + culture events at 25 venues throughout the Downtown Eastside

Website

Winter Farmers Market at Nat Bailey Stadium

When: Running until April 25, 2015, Saturdays from 10 a.m. to 2 p.m.

Where: Nat Bailey Stadium – 4601 Ontario Street, Vancouver

What: Shop locally grown produce + enjoy hot food trucks + live music + more

Website

Moustaches for Movember

When: November 4, 7 to 10 p.m.

Where: Holt Renfrew, Pacific Centre

What: Canada’s largest Movember fundraising event feat. a VIP fashion show, local celebrities, beers, canapés, and more!

Website

Circus Fest Vancouver

When: November 6 to 9

Where: Various venues

What: A 4-day circus festival feat. leading circus acts & performers, Main Stage shows, hands-on workshops, installations, cabarets, and industry panel discussions

Website

Ballet BC presents No. 29

When: November 6 to 8

Where: Queen Elizabeth Theatre

What: Ballet BC’s first performance of the season

Website

Movies at MARKET by Jean-Georges

When: November 7 & 8

Where: MARKET by Jean-Georges restaurant

What: Enjoy a movie in the plush private theatre of the Shangri-La Hotel Vancouver with an elegant meal

Website

An Evening at Ringside

When: November 8

Where: Griffins Boxing & Fitness, North Vancouver

What: An award-winning charity dinner and boxing gala benefitting Big Brothers of Greater Vancouver

Website

41st Annual Circle Craft Christmas Market

When: November 11 to 16

Where: Vancouver Convention Centre

What: Over 310 artisans from coast to coast incl. wood turners + glass blowers + sculptors + potters + entertainment + food + more!

Website

Vancouver International Mountain Film Festival (VIMFF)

When: November 12 to 15

Where: Centennial Theatre & Rio Theatre

What: Watch a unique collection of outdoor and mountaineering films on the big screen

Website

Vancouver Short Film Festival

When: November 14 to 16

Where: Vancity Theatre – 1181 Seymour Street

What: 17 new films and 4 web series showcasing B.C.’s film industry

Website

Shipyards Christmas Market

When: November 14 to 16, 21 to 23, 28 to 30

Where: The Shipyards – 19 Wallace Mews, North Vancouver

What: Over 50 local artisans + food trucks + live music + an outdoor light display + a skating rink from noon to 6 p.m.!

Website

2014 Local Government Election

When: November 15

What: Vote in the general local election from 8 a.m. to 8 p.m.

Website

Hopscotch Festival

When: November 17 to 23

Where: The PNE Forum

What: Vancouver’s premium whisky, beer and spirit festival featuring over 300 kinds of whisky

Website

Eastside Culture Crawl

When: November 20 to 23

Where: Main Street, 1st Avenue, Victoria Drive

What: Annual visual arts festival that involves artists on Vancouver’s Eastside opening their studios to the public

Website

Il Mercato: Italian Night Market

When: November 21, 3 to 7 p.m.

Where: 3075 Slocan Street

What: Italian cuisine + music + handmade products from local artisans

Website

Vancouver Christmas Market

When: November 22 to December 24

Where: Queen Elizabeth Theatre Plaza

What: Authentic outdoor German Christmas village + market

Website

Candytown

When: November 22 from noon to 7 p.m.

Where: Yaletown

What: A free holiday festival w/ outdoor shopping + more

Website

The Peak of Christmas

When: November 28 to December 24

Where: Grouse Mountain

What: Sleigh rides + skating + breakfast with Santa + real reindeer + gingerbread village + more

Website

Canyon Lights

When: November 29 to January 3

Where: Capilano Suspension Bridge

What: 250,000 sparkling lights + music + the world’s largest living Christmas tree

Posted on

October 30, 2018

by

Fabrizio Zenone

Buying real estate is about more than just finding a place to call home. Investing in real estate has become increasingly popular over the last 50 years and has become a common investment vehicle.

Although the real estate market has plenty of opportunities for making big gains, buying and owning real estate is a lot more complicated than investing in stocks and bonds. In this article, we'll go beyond buying a home and introduce you to real estate as an investment.

Basic Rental Properties

This is an investment as old as the practice of land ownership. A person will buy a property and rent it out to a tenant. The owner, the landlord, is responsible for paying the mortgage, taxes and costs of maintaining the property.

Ideally, the landlord charges enough rent to cover all of the aforementioned costs. A landlord may also charge more in order to produce a monthly profit, but the most common strategy is to be patient and only charge enough rent to cover expenses until the mortgage has been paid, at which time the majority of the rent becomes profit.

Furthermore, the property may also have appreciated in value over the course of the mortgage, leaving the landlord with a more valuable asset. According to the U.S. Census Bureau, real estate has consistently increased in value from 1940 to 2006, then proceeded to dip and rebound from 2008 to 2010 and has been increasing overall.

There are, of course, blemishes on the face of what seems like an ideal investment. You can end up with a bad tenant who damages the property or, worse still, end up having no tenant at all. This leaves you with a negative monthly cash flow, meaning that you might have to scramble to cover your mortgage payments. There is also the matter of finding the right property. You will want to pick an area where vacancy rates are low and choose a place that people will want to rent.

Perhaps the biggest difference between a rental property and other investments is the amount of time and work you have to devote to maintaining your investment.

When you buy a stock, it simply sits in your brokerage account and, hopefully, increases in value. If you invest in a rental property, there are many responsibilities that come along with being a landlord. When the furnace stops working in the middle of the night, it's you who gets the phone call. If you don't mind handyman work, this may not bother you; otherwise, a professional property manager would be glad to take the problem off your hands, for a price, of course.

Real Estate Investment Groups

Real estate investment groups are sort of like small mutual funds for rental properties. If you want to own a rental property, but don't want the hassle of being a landlord, a real estate investment group may be the solution for you.

A company will buy or build a set of apartment blocks or condos and then allow investors to buy them through the company, thus joining the group. A single investor can own one or multiple units of self-contained living space, but the company operating the investment group collectively manages all the units, taking care of maintenance, advertising vacant units and interviewing tenants. In exchange for this management, the company takes a percentage of the monthly rent.

There are several versions of investment groups, but in the standard version, the lease is in the investor's name and all of the units pool a portion of the rent to guard against occasional vacancies, meaning that you will receive enough to pay the mortgage even if your unit is empty. The quality of an investment group depends entirely on the company offering it. In theory, it is a safe way to get into real estate investment, but groups are vulnerable to the same fees that haunt the mutual fund industry. Once again, research is the key.

Real Estate Trading

This is the wild side of real estate investment. Like the day traders who are leagues away from a buy-and-hold investor, the real estate traders are an entirely different breed from the buy-and-rent landlords. Real estate traders buy properties with the intention of holding them for a short period of time, often no more than three to four months, whereupon they hope to sell them for a profit. This technique is also called flipping properties and is based on buying properties that are either significantly undervalued or are in a very hot market.

Pure property flippers will not put any money into a house for improvements; the investment has to have the intrinsic value to turn a profit without alteration or they won't consider it. Flipping in this manner is a short-term cash investment.

If a property flipper gets caught in a situation where he or she can't unload a property, it can be devastating because these investors generally don't keep enough ready cash to pay the mortgage on a property for the long term. This can lead to continued losses for a real estate trader who is unable to offload the property in a bad market.

A second class of property flipper also exists. These investors make their money by buying reasonably priced properties and adding value by renovating them. This can be a longer-term investment depending on the extent of the improvements. The limiting feature of this investment is that it is time intensive and often only allows investors to take on one property at a time.

REITs

Real estate has been around since our cave-dwelling ancestors started chasing strangers out of their space, so it's not surprising that Wall Street has found a way to turn real estate into a publicly-traded instrument.

A real estate investment trust (REIT) is created when a corporation (or trust) uses investors' money to purchase and operate income properties. REITs are bought and sold on the major exchanges, just like any other stock. A corporation must pay out 90% of its taxable profits in the form of dividends, to keep its status as a REIT. By doing this, REITs avoid paying corporate income tax, whereas a regular company would be taxed its profits and then have to decide whether or not to distribute its after-tax profits as dividends.

Much like regular dividend-paying stocks, REITs are a solid investment for stock market investors that want regular income. In comparison to the aforementioned types of real estate investment, REITs allow investors into non-residential investments such as malls or office buildings and are highly liquid. In other words, you won't need a realtor to help you cash out your investment.

Leverage

With the exception of REITs, investing in real estate gives an investor one tool that is not available to stock market investors: leverage. If you want to buy a stock, you have to pay the full value of the stock at the time you place the buy order. Even if you are buying on margin, the amount you can borrow is still much less than with real estate.

Most "conventional" mortgages require 25% down, however, depending on where you live, there are many types of mortgages that require as little as 5%. This means that you can control the whole property and the equity it holds by only paying a fraction of the total value. Of course, your mortgage will eventually pay the total value of the house at the time you purchased it, but you control it the minute the papers are signed.

This is what emboldens real estate flippers and landlords alike. They can take out a second mortgage on their homes and put down payments on two or three other properties. Whether they rent these out so that tenants pay the mortgage or they wait for an opportunity to sell for a profit, they control these assets, despite having only paid for a small part of the total value.

The Bottom Line

We have looked at several types of real estate investment. However, we have only scratched the surface. Within these examples there are countless variations of real estate investments. As with any investment, there is much potential with real estate, but this does not mean that it is an assured gain. Make careful choices and weigh out the costs and benefits of your actions before diving in.

Posted on

October 19, 2018

by

Fabrizio Zenone

Real estate market analyst Dane Eitel, of Eitel Insights: Metro Vancouver's detached prices will slump further over three years, but skyrocket far past previous peak within a decade

A real estate analyst who accurately predicted Metro Vancouver’s housing crash a year ago says the current slump will stretch out for three more years.

One year ago, Dane Eitel of Eitel Insights forecast that 2018 sales of detached houses in Metro Vancouver would collapse and the average detached house price would fall from the $1.8 million peak in May 2017 to $1.6 million by the third quarter of this year.

As of September, detached housing sales had indeed plunged 40.4 per cent from a year earlier and the benchmark price had hit $1.54 million, according to the Real Estate Board of Greater Vancouver. The average detached sale price was approximately $1.58 million.

Eitel, who applies stock market-style analytics to the housing market, now forecasts that the detached house price in Metro Vancouver will sink in stages to a bottom of $1.4 million by Q3 2020 and trade at the level for another 18 months. The turnaround will begin in January 2022 – and it will be dramatic, he predicts.

“By the end of 2023 we will be back up to the 2017 peak pricing [$1.83 million]. But the breakout will be historic. Especially for those who purchase at or anywhere near the bottom,” Eitel told Western Investor.

He is forecasting that in the following five years to 2028, the average Metro Vancouver detached house price will skyrocket to around $2.8 million – a 100 per cent increase from the 2021 bottom of $1.4 million.

Contradicting BCREA

The continued slump to 2022 is not what the B.C. Real Estate Association (BCREA) is forecasting. The BCREA contends the current downturn is a government-caused blip and recovery is already underway.

According to the association’s calculations, the B.C. market has turned from its trough in June, and since then has seen a relative increase in activity of around 3.5 per cent, on a seasonally adjusted basis.

Cameron Muir, BCREA’s chief economist, said “The B.C. housing market is evolving along the same path blazed by Ontario and Alberta, where the initial shock of the mortgage stress-test is already dissipating, leading to increasing home sales.”

But Eitel said that 40 years of Greater Vancouver detached house sales and average price cycles reveals a trading pattern is established that will play out over the next decade.

He noted that the last long-term cycle began in October of 1987 and ran to 1996, during which time average house prices increased 190 per cent and peaked at $286,000 in February 1995. The average price then dropped 19 per cent to bottom out in December 1996. Prices did not recover to the earlier price peak until November 2002, six years later.

We are seeing a similar pattern today, Eitel said.

Toronto’s “dead-cat bounce”

Eitel said he has applied his analytics to every major city in Canada and that some regions will outperform both Vancouver and Toronto over the short term. He cautioned that the current recovery in the Toronto’s housing market is “a dead-cat bounce” that will soon come to an ugly end.

“There are some markets in Canada that will see strong growth in house prices, even as Vancouver and Toronto decline,” Eitel said, adding that his information is proprietary and available through Eitel Insights.

|

:max_bytes(150000):strip_icc():format(webp)/cutting-the-grass-with-environmentally-friendly-push-mower--winnipeg--manitoba-597292006-5a80c9c83128340036ff8133.jpg)

:max_bytes(150000):strip_icc():format(webp)/Raking-GettyImages-84423419-5c365a3bc9e77c00010d73ad.jpg)

:max_bytes(150000):strip_icc():format(webp)/Lawnwithdeadgrass-GettyImages-184372017-5c365c6346e0fb0001b22673.jpg)

:max_bytes(150000):strip_icc():format(webp)/Dandelionherbicide-GettyImages-484016511-5c365aee46e0fb00010dfac4.jpg)

The Canadian housing market reflected a lot of restraint and not much growth in 2018. Even so, there are reasons to be optimistic when looking forward to the new year ahead. Check out these forecasts for 2019:

The Canadian housing market reflected a lot of restraint and not much growth in 2018. Even so, there are reasons to be optimistic when looking forward to the new year ahead. Check out these forecasts for 2019: