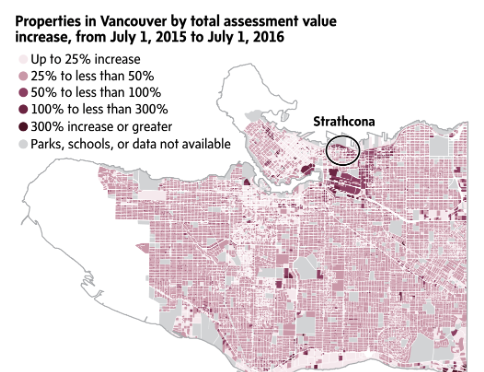

The latest record-setting Vancouver property assessments tell the story of the hottest real estate micro markets around the city. And nowhere is it hotter than the formerly low-income neighbourhood of Strathcona, which butts up against the Downtown Eastside and Chinatown.

The neighbourhood, which is a combination of light industrial, commercial and a village-like residential area, saw the biggest assessment increases in the city. The city averaged about a 30-per-cent overall increase, according to a comprehensive set of BC Assessment data obtained by planner Andy Yan, who is also director of Simon Fraser University’s City Program. Meanwhile, Strathcona averaged a 48-per-cent overall increase, due to high-priced sales that occurred close to July 1, 2016, when properties were assessed. Dunbar-Southlands came second, at 38 per cent. And downtown averaged the lowest increase, at 22 per cent. The relatively small increase in the downtown core is likely because it’s already developed. Areas such as Strathcona that have been undervalued and have development potential have the greatest to gain.

“We have to wonder what is the role of speculative investment in this,” Mr. Yan says. “The increase is obviously above the rate of local incomes increasing, and if this is not supported by local incomes, what is it supported by? Is it ultralow interest rates, global capital or by the outliers flipping?”

Advertisement

#11 Invalid streamType and/or streamServer settings for .

Strathcona has, until recently, been a mostly unrealized gem. The neighbourhood is big on community and heritage protection, and is central to the downtown core. It’s a highly walkable, livable area, surrounded by a light industrial zone that has become trendy with tech industries, coffee shops and restaurants. It draws creative types who crave an urban area rife with old buildings. People with money started taking note back in 2007, when a 114-year-old house set a record when it sold for more than $1-million. Prices have since nearly doubled.

The sale of a house at 740 E. Pender St. set a new record as the highest sale on a standard 25-foot-wide lot this past fall. It was listed at $1.879-million and sold for $1.95-million after nine days on the market. It’s a two-storey, 3,171-square-foot character house with a one-bedroom basement suite. As a rental, the house brought in $6,000 a month. It sold far above its assessment of $1.629-million.

Although the house sold to another Strathcona resident, a big part of the drive behind the big prices is the migration of west side residents into the area, says realtor Dwayne Launt. A west side couple paid $1.85-million last year for a 2,000-square-foot house on a 25-foot lot on Union Street.

“A lot of the big purchase prices are coming from people moving out of Point Grey and Dunbar,” Mr. Launt says. “We have a lot of people who’ve cashed out and their kids moved out – sometimes older people who don’t need a 50-by-something-foot lot on a big, sprawling yard. They want something more urban, and they want to go back to a sense of community. That’s the biggest thing for them, just like you see with all these east side neighbourhoods.”

Also, he says, boomer-age parents on the west side are spending so much time visiting their grown kids on the east side, they figure they may as well move there, too.

“They’re the grey wave who can now give the kids money for property, and they have more money to play with. They think, ‘We’re driving into the east side two or three times a week anyway, why don’t we just move over there?’ That’s some of our clientele, definitely. They’re driving values. There are no foreign buyers buying in Strathcona, although that may happen soon.

“There are some speculators, but most people are wanting to live there, absolutely. And there is the odd person buying multiple houses because they can rent them for a lot. You can rent out a basement suite in Strathcona for $1,800.”

Ilka Riemann is a Strathcona homeowner who owns a second house in the neighbourhood that she rents out to young professionals. She’d like to keep the rent affordable. Her houses increased in value by 42 per cent and 43 per cent, which will likely result in a future tax increase.

“Not only that, but I won’t get the homeowners grant any more,” she says. (The value increases could put her houses above the program’s threshold.) “At this rate, what is next year going to bring? I’ll see whether or not I can keep it up. I don’t think I can.”

BC Assessments regional assessor Jason Grant says it was a notable year overall for property value increases.

“What I can say is that there would only be a couple of times since the early 1980s when the single-family residential market in the Lower Mainland moved as much as it did from July 1, 2015 to July 1, 2016,” he said.

Massive commercial property hikes also drove the Strathcona figures, including some properties along Railway Street that saw 300-per-cent increases in values. Several business owners are planning to appeal the valuations. Long-time Inform Interiors owner Niels Bendtsen says he is considering moving his business out of Vancouver because of the increased taxes he’ll be facing.

Joji Kumagai, executive director of the Strathcona Business Improvement Association, says he suspects the increases are the result of speculative investments in the area. He says the latest assessments saw some properties around Railway average a 232-per-cent increase and other industrial properties in Strathcona average 100-per-cent to 145-per-cent increases.

“It’s a straight line upward, basically,” he says. “We haven’t seen that before.”

As a result, he’s hearing from business tenants that are caught off guard by tax increases. As well, the rise puts pressure on all business owners that depend on a work force that can afford to stay in the area.

“We’ve heard quite a few businesses say they are having a hard time finding the right workers, and the distance people have to travel to get to work, so if they could only offer a certain wage and that person is coming from Langley or something, they know they won’t stick around. You start hiving off the potential work force. There’s a real consequence to this.”

While residential properties are the hot topic in the Lower Mainland, commercial and industrial zones are interconnected because they make the city function. Take away industry and jobs, and you’ve got a resort town.

“This is one of the last areas where actual industrial uses can still function,” Mr. Kumagai says. “A lot of people don’t think about what they actually contribute, but they are important in terms of resilience to the economy. It’s a wealth-generating process.”

Mr. Yan used to release a map that showed the city divided between the single-family houses that sold for above $1-million and those that sold below that amount. Each year, his $1-million line crept further east. Some time between January, 2016, and July, 2016, it disappeared. He says soaring assessments may feel like a win to the homeowner, but he questions their intrinsic value.

“I think that on paper it looks like you’re winning, but isn’t this really about how we all lose as a vibrant and sustainable city? It’s a genuine question for renters, startup entrepreneurs, young families, seniors – who really wins when property prices go up this fast in such a short time? And what are the consequences?”

Comments:

Post Your Comment: