Deadline to appeal assessment is February 1, 2017

Property owners who disagree with their assessment should do homework by:

- comparing their assessment with neighbouring properties; and

- contacting BCA at 1-866-valueBC (1-866-825-8322) and talking to staff who can make adjustments if there is an obvious error, for example if BCA included a complete renovation when there was merely a spruce-up.

Property owners who decide to appeal their property assessment should review information on the Property Assessment Appeal Board website on how to prepare for an appeal and then complete a Notice of Complaint (Appeal) Form. (Step 7)

The deadline to file an appeal is February 1, 2017.

Each year less than 1% of BC property owners appeal their assessments.

Note: you can’t appeal your taxes. You can only appeal your assessment.

For information about BC Assessment and to access e-valueBC visit: www.bcassessment.ca or phone 1-866-valueBC (1-866-825-8322).

Did you know?

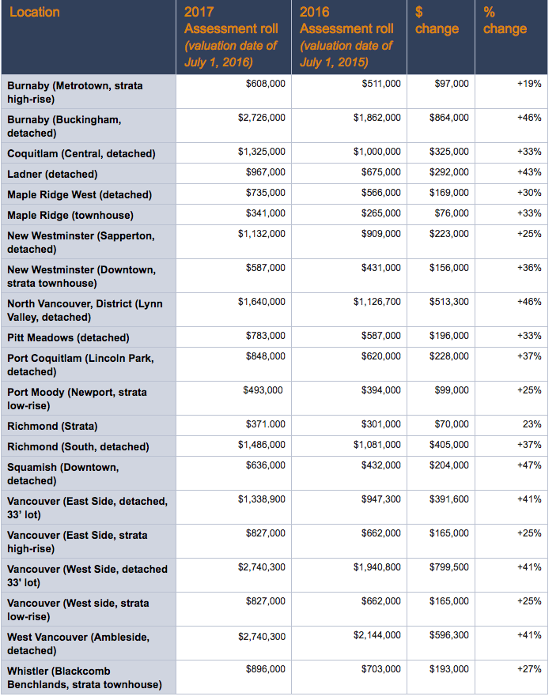

- Total value of real estate on the 2017 BC assessment roll is $1.67 trillion, an increase of 25% from 2016.

- In BC, 88% of all properties are classified with some residential component (class 1), equating to $1.29 trillion.

- Changes in property assessment reflect movement in the local real estate market and can vary greatly from property to property.

- Real estate sales determine a property’s value which is reported annually by BCA.

- BCA’s assessment roll provides the foundation for local and provincial taxing authorities to raise $7 billion in property taxes each year, which funds community services including the school system.

Comments:

Post Your Comment: