Posted on

February 2, 2017

by

fabrizio zenone

Metro Vancouver housing market off to a quieter start than last year

Home sales and listings trends are below long-term averages in the Metro Vancouver* housing market. This is due largely to reduced activity in the detached home market.

Residential property sales in the region totalled 1,523 in January 2017, a 39.5 per cent decrease from the 2,519 sales recorded in January 2016 and an 11.1 per cent decrease compared to December 2016 when 1,714 homes sold.

Last month’s sales were 10.3 per cent below our 10-year January sales average.

“From a real estate perspective, it’s a lukewarm start to the year compared to 2016,” Dan Morrison, Real Estate Board of Greater Vancouver (REBGV) president said. “While we saw near record-breaking sales at this time last year, home buyers and sellers are more reluctant to engage so far in 2017.”

New listings for detached, attached and apartment properties in Metro Vancouver totalled 4,140 in January 2017. This represents a 6.8 per cent decrease compared to the 4,442 homes listed in January 2016 and a 215.5 per cent increase compared to December 2016 when 1,312 properties were listed.

The total number of homes currently listed for sale on the Multiple Listing Service® (MLS®) in Metro Vancouver is 7,238, a 9.1 per cent increase compared to January 2016 (6,635) and a 14.1 per cent increase compared to December 2016 (6,345).

The sales-to-active listings ratio for January 2017 is 21 per cent. This is the lowest the ratio has been in the region since January 2015. Generally, analysts say that downward pressure on home prices occurs when the ratio dips below the 12 per cent mark for a sustained period, while home prices often experience upward pressure when it surpasses 20 per cent over several months.

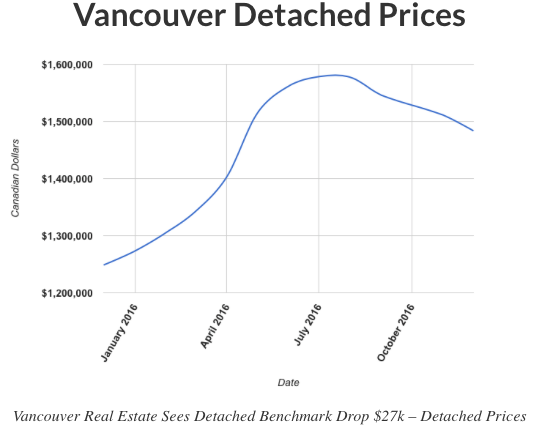

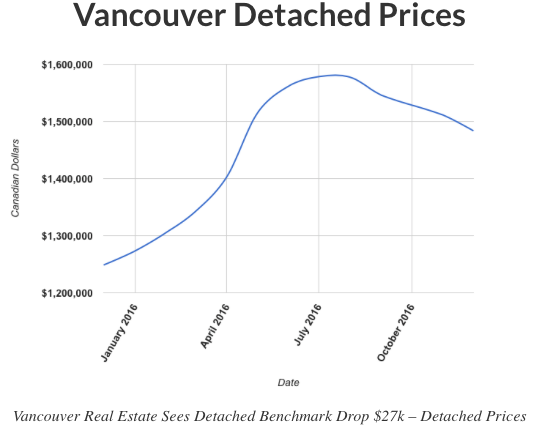

“Conditions within the market vary depending on property type. The townhome and condominium markets are more active than the detached market at the moment,” Morrison said. “As a result, detached home prices declined about 7 per cent since peaking in July while townhome and condominium prices held steady over this period.”

The MLS® Home Price Index composite benchmark price for all residential properties in Metro Vancouver is currently $896,000. This represents a 3.7 per cent decline over the past six months and a 0.2 per cent decrease compared to December 2016.

Sales of detached properties in January 2017 reached 444, a decrease of 57.6 per cent from the 1,047 detached sales recorded in January 2016. The benchmark price for detached properties is $1,474,800. This represents a 6.6 per cent decline over the last six months and a 0.6 per cent decrease compared to December 2016.

Sales of apartment properties reached 825 in January 2017, a decrease of 24.7 per cent compared to the 1,096 sales in January 2016.The benchmark price of an apartment property is $512,300. This represents a 0.3 per cent increase over the last six months and a 0.4 per cent increase compared to December 2016.

Attached property sales in January 2017 totalled 254, a decrease of 32.4 per cent compared to the 376 sales in January 2016. The benchmark price of an attached unit is $666,500. This represents a 0.4 per cent decline over the last six months and a 0.7 per cent increase compared to December 2016.

Posted on

February 2, 2017

by

Fabrizio Zenone

ns ns

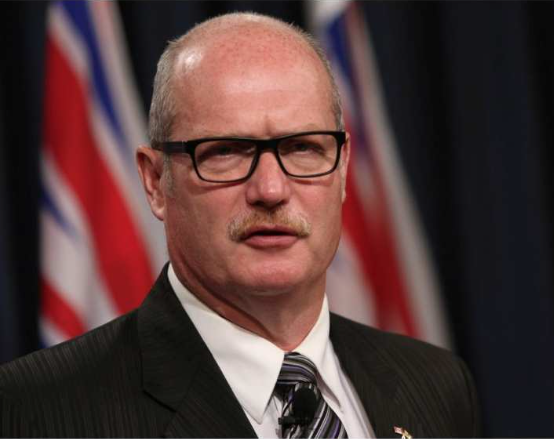

VICTORIA — B.C. is considering refunding the foreign buyer tax to some buyers, says the finance minister.

Mike de Jong said Wednesday the refund idea is one of several reforms under his consideration as part of changes to the six-month-old 15 per cent foreign buyer tax on real estate sales in Metro Vancouver. It comes after Premier Christy Clark announced last week exemption.

for foreigners with work permits, as part of B.C.’s response to immigration orders by U.S. President Donald Trump.

The rebate under consideration appears to apply to those people who paid the new foreign buyer property transfer tax on a home, but then shortly afterwards obtained Canadian citizenship or permanent resident status that would have originally exempted them from that tax.

“It’s one of the things that has been presented that we’re looking at, in terms of someone who has made a purchase and then in a very short period of time meets the criteria and acquires the status whereby they wouldn’t have had to pay the tax,” de Jong said in an interview Wednesday.

“We do this with things like the first time buyers exemption around residency and that sort of thing,” he added.

B.C.’s first time home buyers’ program gives a tax break to certain Canadian citizens and permanent residents, but it also allows people who become citizens or residents within 12 months of the purchase to apply for a rebate on savings they’d missed.

De Jong said he’s considering other ways to make the tax fairer, as government analyzes the impact of its abrupt August 2016 implementation. The tax was supposed to cool an overheated housing market in the Lower Mainland, but caught many by surprise because it came from a government that had been reluctant to pin any blame on wealthy foreign buyers.

“It was an example of policy shock,” admitted de Jong. “And so, in the aftermath, people have raised certain specific circumstances. That analysis is ongoing.”

The tax’s fundamentals — such as its rate and focus on the Lower Mainland — aren’t yet up for debate.

“There’s not going to be change in the rate and I rather suspect there will not be a change at this point in the applicable geography,” said de Jong, dismissing calls to expand the tax to southern Vancouver Island and the Okanagan.

NDP critic David Eby said government’s consideration of rebates is the least it could do for people who lost their deposits, and in some cases their entire real estate deal, because of the sudden impact of the foreign buyer tax.

“It was devastating for them,” said Eby. “At a minimum, the government should be moving quickly to fix this problem but they should have recognized this was a problem in the first place.”

Eby and the Opposition NDP proposed the foreign buyer tax exemption for people with work permits last year, but the idea was dismissed by de Jong and the governing Liberals.

Posted on

January 31, 2017

by

fabrizio zenone

Thinking about selling your house, but it could use a little TLC? You can't sweep all of your home problems under a giant rug. However, there are some cheap DIY hacks that can bump up the value of your home — sometimes by as much as 20 percent.

The exterior is a buyer's first impression —and sometimes a bucket, soap and water is all you need to clean it up. You can also rent a power washer and hit the deck, the stairs and gutters.

Add some curb appeal by taming your overgrown lawn, adding a splash of color into the landscaping and giving shape to those hedges. Also consider tacking on some new address digits to keep things looking fresh and new.

Before shelling out those big bucks to paint your entire home, try painting shutters and doors to really make your property pop.

In terms of the interior, bold colors don't always mean beautiful. In fact, bright hues tend to devalue overtime. Stick to neutral colors, but stay away from plain white walls.

When it comes to selling value, the kitchen is the most important room of the house. Finish off those cabinet doors with some upgraded hardware, and add a kitchen island for extra counter space and style.

When it comes to the bathroom, consider changing the sink faucet, installing a new medicine cabinet, and getting a new toilet seat. New shower curtains and rugs can go a long way in making things fresh, too. You can also replace light switch covers for a quick fix, and add shelves in a closet for extra storage.

So, stop dreaming and start fixing.

Getting top dollar for your house today can finance your reality tomorrow.

Posted on

January 31, 2017

by

Fabrizio Zenone

Many new commercial real estate projects – such as Burnaby’s Brentwood Town Centre and the mixed-use Burrard Place complex (right) in Vancouver – rely on a hefty residential component.

It is impossible to crowbar residential investors from the future of the commercial real estate sector in Metro Vancouver because it is the lowly homebuyer who has been driving commercial land and property deals to new levels.

For evidence one need only look at Metro commercial real estate transactions during the first nine months of 2016: sales of land for residential development accounted for 53 per cent of total volumes and dwarfed every other type of commercial real estate.

Add in the 109 sales of multi-family rental buildings and residential made up $5.8 billion of the total $9.5 billion in commercial transactions as of September 2016, a dominance that has characterized the Metro market for two years.

Yet the muscle of the homebuyer goes beyond these numbers.

Today, many commercial developments rely on a healthy mix of condominiums to make the numbers work, whether in office and retail projects and even, lately, in industrial and hotel developments.

The current weakening of the residential market could affect Metro Vancouver’s commercial real estate into 2017.

Office sector

Despite a rush of new office developments that has added about two million square feet of prime space in the past 18 months, Vancouver’s office vacancy rate has fallen to 6.9 per cent, one of the lowest in Canada, according to Colliers International. With nearly 340,000 square feet taken up in the third quarter of 2016 alone, the stage is set for the next round of hurry-up construction.

Office demand across the Metro region is expected to increase in 2017 following recent federal approval of new liquefied natural gas and oil pipelines, an expanding tech and film industry and a strengthening of the mining and engineering sectors.

In all, four new towers are planned with a total of 600,000 square feet of Class A space. Early betting is that Morguard’s 227,000-square-foot, 25-storey building at 601 West Hastings will lead the wave, with an estimated completion in 2019.

Two new office towers, the Exchange on Howe Street by Credit Suisse and Serracan Properties’ seven-storey building on Seymour Street will complete in 2017.

Needless to say, many of Vancouver’s new office projects, such as the 235,000-square-foot Burrard Place by Jim Pattison Developments/Reliance Properties, and the Cardero complex by Bosa Properties/Arpeg Holdings include a residential component.

This year could also see heated action in office transactions. Last year, a record $1.9 billion in office building sales were reported in the first half alone.

The relatively low vacancy rate, high demand and rising total lease rates – an average of $47.28 per square foot downtown – also point to office investments breaking to the upside in 2017.

Retail record

The first half of 2016 saw record transactions of retail properties in Metro Vancouver, as the sales volume hit $1.1 billion, according to Altus Group.

The demand is fueled by B.C.’s stupendous retail sales. In 2016, consumer sales volumes in B.C. hit $74.9 billion, up 6.6 per cent from a year earlier, the highest growth rate in the country, according to Colliers’ research.

And, even with the opening of Canada’s largest new indoor shopping mall in South Delta in 2016, Metro Vancouver remains under-supplied with retail, Colliers found.

Metro Vancouver now has 14.3 square feet of shopping space per capita, the lowest among all big Canadian cites and well below the ratio in Toronto and Calgary.

The largest Metro retail makeover projects, Brentwood in Burnaby and Oakridge Centre in Vancouver, both have a strong residential component.

Hotels versus condos

Metro Vancouver is the best hotel market in Canada, according to HVS International, but 2017 will see residential action shadowing both new hotel development and makeovers.

The Trump International Hotel & Tower, which opens in 2017 in downtown Vancouver, has drawn headlines because of the sell out of its condominium component at more than $1,200 per square foot.

Other hoteliers are competing head to head with homebuilders for sites, but Carrie Russell, managing director of a HVS Canada in North Vancouver, said this can be expensive.

“Vancouver hotel developers literally have to compete with condo developers, and it just does not make very many deals economic,” she said.

Posted on

January 31, 2017

by

Fabrizio Zenone

VANCOUVER — British Columbia’s premier has announced her government is amending its tax on foreigners buying property in Metro Vancouver.

Christy Clark says the levy will be lifted for those who have a work permit and pay taxes in B.C., in order to encourage more people to come to the province.

The 15 per cent foreign buyers tax was implemented last August in a bid to cool skyrocketing real estate prices.

Government data released earlier this month shows there was a steep drop in real estate transactions in the Vancouver area last summer after the tax was introduced.

Tax revenues from property transfers in Metro Vancouver show there were about 15,000 transactions in an approximately seven-week period ending Aug. 1, but the number dropped to a low of about 4,700 for the month of October.

The data shows there were about 1,970 purchases involving foreign buyers in the period ending Aug. 1, compared to 60 in the rest of August and about 200 in November.

Posted on

January 26, 2017

by

Fabrizio Zenone

The latest edition of an annual survey by global statistics consultancy Demographia found that Vancouver is the third least affordable metropolitan housing market in the world as of the beginning of 2017, coming right after Hong Kong and Sydney, Australia.

With the median home price ($830,100) being over 11 times higher than the median monthly household income ($70,500), this represented the second consecutive year that Vancouver has ranked third after placing second in 2015, GlobalNews.ca reported.

Out of the 406 markets surveyed, Vancouver was the only Canadian city to rank in the top 10 list of the least affordable housing markets.

And since 2004, Vancouver has been consistently ranked by Demographia as the Canadian city with the highest prices relative to median household income.

However, Greater Vancouver’s benchmark price for detached homes has exhibited a slight 5 per cent decline (down to $1.4 million) ever since the introduction of the 15 per cent foreign buyer’s tax in August 2016.

The city’s sales numbers have fared worse, with figures from the B.C. Finance Ministry showing that the ratio of real estate deals involving foreigners declined to less than 1 per cent after the tax was levied last year. In

addition, the $14 billion in real estate transactions in Vancouver over the 7 week prior to August 1 dwindled to a mere $3.7 billion in October.

“There is a huge drop,” Andrey Pavlov of the Simon Fraser University said. “There may be some seasonal variation, like there normally would be on all transactions, but the drop is so significant that it couldn’t possibly be explained by seasonal variation.”

B.C.’s weaker housing sector poses dire implications for the provincial economy, which has been forecast by finance officials to ratchet down its performance this year.

Finance Minister Mike de Jong projected that 2017 growth will be “modest” compared to the previous year, noting that the province’s budget surplus will be around $2.2 billion.

Posted on

January 18, 2017

by

Fabrizio Zenone

Vancouver real estate got some more bad news from the REBGV. December stats show single-family homes dropped in prices, sales, and listings.

You have to be quite the optimist these days to be in Vancouver real estate. First BCREA predicts the benchmark will drop 8.7%, then the Real Estate Board of Greater Vancouver (REBGV) releases this months report. According to the latest numbers from the REBGV, the benchmark price for detached homes dropped, sales plummeted, and listings are disappearing.

Prices Dropped

The benchmark price of a detached home took a hit in December. According to REBGV, in the Greater Vancouver Region the price dropped 1.8% from the month prior to $1,483,500. Detached homes across Lower Mainland dropped 1.3% to $1,198,700. Even with the price drop, affordability isn’t high on the list of attributes for detached units.

All but three areas in the REBGV territory fell, with the trend being more pronounced in the suburbs. Ladner had the biggest drop, with benchmark prices falling 3.3% to $980,600. Benchmark price drops in December are seasonal in most markets, but it’s been a trend Vancouver has been bucked in the past.

Sales Plummeted

Bubble talk seems to be impacting buying decisions in Vancouver, as sales plummeted. REBGV cited 541 sales in the notes, but only 537 in the detached statistics. Either way, that’s at least a drop of 15% from the month before, and a whopping 52.4% from the same time last year. Higher prices generally reduce the number of sales, but that’s a pretty big drop in my opinion. Prices will have a hard time moving forward if buyers aren’t showing up.

Listings Are Down

Adding more mystery to the market is the limited number of single-family detached homes actually listed for sale. Listings plummeted 57.4% from the month before to 513, which is also a 38% decline from the same time last year. Theoretically, less inventory usually results in upward pressure on prices – not this time apparently.

I’ve said it before, and I’ll probably say it many more times in the future – one report isn’t a trend. This could theoretically be a seasonal adjustment, but it’s getting harder to follow that narrative when even BCREA is saying to expect a decline.

Posted on

January 17, 2017

by

Fabrizio Zenone

Apple could be planning to boost the number of devices that fall under its free battery replacement program.

The tech giant is weighing whether to include the iPhone 6 in a battery replacement program that currently includes the company's iPhone 6s, Japan-based Apple-tracking site Macotakara is reporting, citing sources. While it's not immediately clear why Apple would launch a program now, the iPhone 6s takes its design concepts from the iPhone 6, which was released in 2014. Last year, a small number of iPhone 6s owners reported that the smartphone would shut down with battery life still left on the device. Users reported that their iPhone 6s would display it had 30% battery life remaining, only to shut down as if its battery was out of charge. Soon after, Apple said that the problem was attributable to a fail-safe built into the handset, which would automatically shut down the battery in the event its voltage was too low. Apple then said that it would offer free replacements on affected devices.

While that was believed to have been the end of the problem, some iPhone 6 owners said that they were affected by battery problems as well. In November, the Chinese consumer-protection agency, China Consumers Association, even noted the iPhone 6 in a statement supporting consumers.

In view that Apple iPhone 6 and iPhone 6s series cellphones in China have a considerable number of users, and the number of people who’ve reported this problem is rather many, China Consumer Association has already made a query with Apple,” the agency said in an open letter.

'Some online forums also list both iPhone 6s and iPhone 6 owners sharing battery woes. It's unclear, however, whether those affected users are suffering from the same manufacturing problem.

For its part, Apple capped the program at the iPhone 6s last year. However, expanding a battery replacement to older devices isn't unprecedented: Apple still offers free battery replacements on iPhone 5 units that have their own charge-keeping problems.

Apple has yet to announce a program expansion to the iPhone 6 and did not immediatley respond to a Fortune request for a comment.

Posted on

January 17, 2017

by

Fabrizio Zenone

WASHINGTON—Donald Trump will be sworn in is as America’s 45th president on Friday with a speech he has suggested will be inspired by Ronald Reagan and John F. Kennedy.

His transition has not been like theirs.

Or anybody’s, really.

Trump has raged through the two months since his victory, casting aside norms of decorum, policy and international relations while refusing to temper the anger that thrilled millions of voters while scaring much of the world.

Here are 11 things his transition has taught us about the president-to-be and his looming administration:

It wasn’t just rhetoric: Trump supporters and critics alike brushed off much of his campaign rhetoric as bluster, strategic metaphor to be discarded the day after the campaign. His preposterously tall Mexico wall seemed a prime example. In fact, he appears serious about building a barrier, even if it doesn’t precisely match his previous description. While he has backed off on other pledges — ripping up the Iran deal, for example — it wasn’t all nonsense.

Ball of confusion: Democrats used the Senate confirmation hearings for Trump’s Cabinet nominees to grill them on his most controversial remarks. Instead of defending the boss, as nominees are usually expected to do, they simply disagreed — on Russia, on torture, on climate change, on NATO. Will his views or their views prevail? Until further notice, there’ll be an unusual degree of policy uncertainty.

Expect upheaval: Forget his campaign words. During the transition alone, Trump has declared the “One China” policy up for negotiation, suggested he still thinks NATO is “obsolete,” said he doesn’t care what happened to the European Union, and expressed a desire for closer ties with Russia. For better or worse, he was signalling the dawn of a new international order, with America’s role in the world transformed. The consequences of this kind of realignment are impossible to predict.

Look, a fly!: Trump has a famously short attention span. His transition conduct suggests he might have trouble focusing on the weighty matters of governance at the expense of trivialities. Exhibit A: while he has declined to receive a standard daily intelligence briefing, he has made time to weigh in on the table settings for inauguration balls.

Republicans won’t stand in his way on conduct: The chairman of the House oversight committee, Utah Rep. Jason Chaffetz, aggressively pursued investigations into the official conduct of Hillary Clinton. He is now making clear that he has no intention of spending much energy overseeing the dealings of the party mate in the Oval Office. Unless Democrats win back the House in 2018, don’t expect much checking-and-balancing from Congress . . . .

. . . but Congress is where the policy action is: Trump is a master attention-monopolizer, and it’s tempting to obsess over every pronouncement and feud. The meaningful action, though, will often be in intraparty policy battles between congressional Republicans, especially as the incoming president usually has little interest in specifics. On Sunday, as Trump set Twitter alight with a vague proclamation that his Obamacare replacement would include “insurance for everybody.” Republicans were working on plans that would not do so.

Resistance is possible: Republicans control the entire federal government, and Democrats are demoralized. That doesn’t mean they can’t get results. A public uproar, led by the left and joined by Trump, pressured Republicans into abandoning plans to gut an ethics watchdog.

He’s no invincible juggernaut: It’s understandable if everyone is a little suspicious of polls at the moment. But national polls were pretty accurate; Trump lost the popular vote by two percentage points after trailing in the polls by three, and national polls now show him with an approval rating in the 40s, 20 points worse than his three predecessors at this stage. His base is loyal, but not big. A big error or two might make him toxic fast . . . .

…but he is a formidable political force: Betting on a quick impeachment? It is more likely that Trump again proves unexpectedly successful. His command of political showmanship, evident again in his skilful claiming of credit for job creation that has little to do with him, allows him to establish powerful narratives before the facts can catch up.

Ethics problems abound: Ethics-in-government experts are unanimous: to avoid conflicts of interest, Trump needs to sell his company. He isn’t doing so. His decision to merely hand over management control to his sons guarantees that there will be clashes between his private business and his official duties . . . and very possibly the constitution.

Healing isn’t happening: Trump delivered a gracious victory speech in which he said “is time for us to come together as one united people.” He has made no effort to make that happen. Between mocking Hillary Clinton and Jeb Bush, insulting civil rights legend John Lewis and turning a Happy New Year tweet into a gloat, Trump has proven unwilling to attempt to heal the wounds of the campaign. By all indications, this will be a scorched-earth presidency.

Posted on

January 17, 2017

by

Fabrizio Zenone

Applications are open for the B.C. government's new Home Partnership program, which provides loans of up to $37,500 to help first-time homebuyers fund their down payment in the province's pricey housing market.

Those already hunting for their first home, however, should know the loans are not available right away — the closing date on a purchase must be after Feb. 15, 2017 for your application to be considered.

Premier Christy Clark has said the second-mortgage program will help first-time homebuyers get into the "really tough housing market," but critics say it exposes buyers to too much debt and favours "a very privileged set of people."

"If you get into the marketplace and get a little bit of equity, it can change your life," said B.C. Housing Minister Rich Coleman, who shared the story of his first home — a mobile home in Alberta — before building his own house a year later.

"The challenge of course is coming up with that down payment."

Coleman said Monday afternoon that about 60 applications had already been started, 29 were submitted, and eight would receive letters of approval on Tuesday.

How it works

The B.C. Home Owner Mortgage and Equity Partnership (or HOME Partnership) program lets eligible first-time homebuyers take out a second mortgage from the government.

The government loan has a 25-year term, without interest or payments for five years.

After five years, interest will start accruing and the buyer has to start repaying the loan, at whatever interest rates apply at that time.

The loan can be up to five per cent of the purchase price of the home. For example, an eligible buyer purchasing a home for $600,000 could borrow up to $30,000 from the government under the program.

The loan will be registered on the property title as a second mortgage, along with legal costs the homeowner will owe B.C. Housing.

When asked about the risk of first-time buyers taking on two mortgage payments — one to the bank and one to the B.C. government — Coleman said he didn't expect it would be a problem.

The loan has to be fully repaid when the home sells and Coleman said data show many buyers sell their first home within seven years.

How to apply

The time to apply is after you've saved for a down payment and get pre-approved for a mortgage — but before you actually start making offers on properties, according to B.C. Housing.

Applications with supporting documents can be made online, starting Monday. The closing date on a deal must be after Feb. 15 for an application to be considered.

Once approved, applicants can make an offer on a home knowing the loan amount that will be available to them from B.C. Housing and the legal costs they'll have to pay to take out the loan.

To be eligible, an applicant needs to be a Canadian citizen or permanent resident for five years, live in British Columbia, have a household income under $150,000 per year, be pre-approved for a high-ratio mortgage, among other requirements.

The applicant also has to be buying a home for less than $750,000 that will be used as their principal residence for five years.

The program ends March 31, 2020.

Posted on

January 13, 2017

by

Fabrizio Zenone

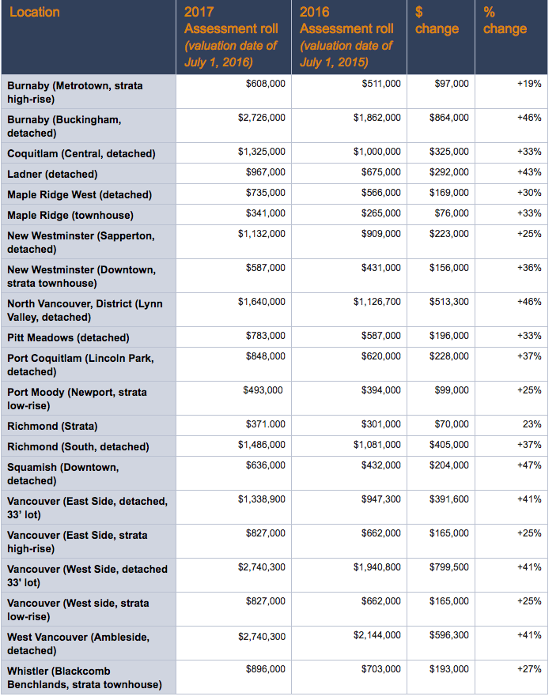

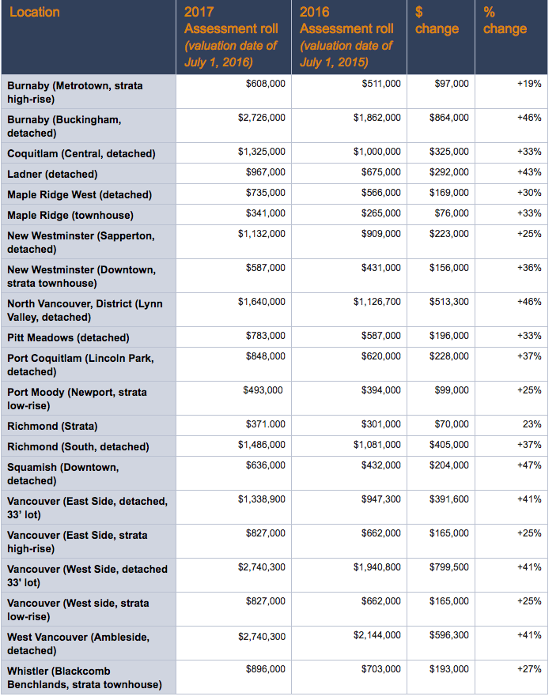

Deadline to appeal assessment is February 1, 2017

Property owners who disagree with their assessment should do homework by:

- comparing their assessment with neighbouring properties; and

- contacting BCA at 1-866-valueBC (1-866-825-8322) and talking to staff who can make adjustments if there is an obvious error, for example if BCA included a complete renovation when there was merely a spruce-up.

Property owners who decide to appeal their property assessment should review information on the Property Assessment Appeal Board website on how to prepare for an appeal and then complete a Notice of Complaint (Appeal) Form. (Step 7)

The deadline to file an appeal is February 1, 2017.

Each year less than 1% of BC property owners appeal their assessments.

Note: you can’t appeal your taxes. You can only appeal your assessment.

For information about BC Assessment and to access e-valueBC visit: www.bcassessment.ca or phone 1-866-valueBC (1-866-825-8322).

Did you know?

- Total value of real estate on the 2017 BC assessment roll is $1.67 trillion, an increase of 25% from 2016.

- In BC, 88% of all properties are classified with some residential component (class 1), equating to $1.29 trillion.

- Changes in property assessment reflect movement in the local real estate market and can vary greatly from property to property.

- Real estate sales determine a property’s value which is reported annually by BCA.

- BCA’s assessment roll provides the foundation for local and provincial taxing authorities to raise $7 billion in property taxes each year, which funds community services including the school system.

Posted on

January 13, 2017

by

Fabrizio Zenone

Taking its cues from its luxury boutique Loden Hotel in downtown Vancouver, Amacon’s Imperial infuses elements from the developer’s award-winning hotel into all of its homes at Imperial. The lobby, the amenities and the homes have been well considered, inspired by a “tailored to perfection” vision carried out through the design process.

Rising 26 storeys, Imperial is named for its location on Imperial Street in the Metrotown neighbourhood, steps to everything this growing neighbourhood has to offer – restaurants, SkyTrain, parks, recreation and shopping.

A hotel-style lobby will combine the look of luxury and with an elevated, full-service concierge to provide the sense of arrival one would expect upon arrival to a hotel.

Offering a collection of 169 homes, Imperial is about choice, with one-bedroom through to three-bedroom tower homes, including a townhome collection, live-work homes and penthouses.

Imperial is also all about quality time, whether it’s that quiet solitude on your spacious deck or in living room catching up on a good read while taking in expansive views, or family dinners, lovingly prepared in the well-appointed kitchen. Everything inside these contemporary homes is comfortable and well thought-out, built for the way people live today. With nine-foot ceilings, air conditioning, USB receptacles, a large-capacity washer and dryer, and custom organizers in the master bedroom closets, all homes include those interior design elements that speak to ease and comfort.

In the kitchen, integrated appliances, full-height cabinetry, a convection wall oven, five-burner gas cooktop and polished-quartz waterfall countertops are included. In the bathrooms, Moen brand fixtures, custom medicine cabinets and a pull-out vanity organizer continues the tailored look and feel of Imperial.

The private amenities space will be outfitted by a fully equipped fitness centre, a yoga studio, a business meeting room, a music room, a games room and a guest suite. A large social lounge will boast a social a full kitchen and two large dining tables, perfect for larger gatherings. The social lounge also opens to a large outdoor terrace with garden plots for those green thumbs. And if sustainability appeals to you, Imperial also offers a car- and bike-share program.

With more than five decades of excellence in the industry, Amacon has a stellar track record. Opening in October, the Imperial presentation centre, which includes a two-bedroom show home and two kitchen vignettes, is located at 4700 Imperial, Burnaby.

Posted on

January 12, 2017

by

Fabrizio Zenone

Condo king Bob Rennie has been the target of many lawsuits, but for over four decades, the power broker says he has never taken action to sue anyone himself. Until now.

Rennie Marketing Systems is suing Vancouver-based Shape Properties Corp. for more than $16 million in real estate marketing fees related to the sale of more than 1,300 condo units at developments near Brentwood Mall in Burnaby, according to a notice of claim filed in B.C. Supreme Court.

In June 2016, Shape and its partners, including multi-billion-dollar, Toronto-based pension funds, terminated Rennie’s services on the massive mixed-used, retail, office and residential project. They decided to market the project in-house despite three towers of condo units nearly selling out and the defendants “having learned the Rennie Platform from Rennie Marketing Systems,” states the claim.

“There’s not a lot to say,” said Rennie. “I have never sued anyone in 42 years in business, so it’s not a comfortable spot.”

The allegations in the claim have not been tested or proven in court.

Shape president John Horton said: “My view is that there is no merit to this claim. We will vigorously defend (it) in due course.”

Rennie started working in 2011 with Shape and its partner companies that are associated with the Healthcare of Ontario Pension Plan to market the “Amazing Brentwood” project, a 28-acre site at Lougheed and Willingdon next to Brentwood shopping centre, according to the claim. The vision was a “master planned community” with 13 high-rise residential towers.

“Rennie Marketing Systems was instrumental in developing this concept and in the planning, branding and market positioning of the project,” states the claim.

The lawsuit, filed at the end of December, said Rennie began marketing for this project in 2013 and also started drawing up similar plans for “City of Lougheed,” a separate, 40-acre site in Burnaby co-owned by Shape and companies associated with Greystone Capital Management, a Regina-based firm that invests $32 billion on behalf of pension and endowment funds for Canadian universities, unions and companies.

The Lougheed project plan also contains mixed-use retail and office space and a plan for 23 high-rise residential towers.

The companies agreed for Rennie Marketing to receive a fee for each condo sold, based on a confidential percentage of the sale price, with half paid by Shape to Rennie when buyers signed a firm, pre-sale contract and the remaining due when the condos were completed and the deals closed. Shape would also pay a monthly advance. The claim said even though Shape failed to sign the agreement for six months, Rennie allegedly staffed up a sales centre and nearly sold out two towers of 845 condo units at Brentwood between 2013 and 2015.

Shape paid the monthly advances, but in April 2015, it requested a reduction in fees “in light of the number of towers being planned for the two projects.”

The claim said that Horton proposed for Rennie to exclusively market other future projects to be developed by Shape and Greystone.

Rennie made several proposals for fee reductions, but did not hear back from Shape even though it “continued to work intensively with Rennie,” said the claim.

By April 2016, according to the claim, Rennie had nearly sold out a third tower at Brentwood when Shape asked to keep the presentation centre there staffed with sales agents and coordinators to direct potential customers to its Lougheed project.

Then, in June 2016, Horton advised Rennie that Shape was terminating Rennie Marketing Systems’ services on both projects, according to the claim.

In total, Rennie’s company is seeking $16, 464,650 for unpaid fees and damages for breach of contract, but Rennie said, “the large size of the claim is distorted. There were 960 brokers who sold condos. It’s not $16 million goes to Bob. We’re a clearing house for the agents who sold 1,300-plus units.”

Horton said he couldn’t elaborate as the company readies a reply to the claim, but described the move as a “business decision”, adding: “We are a real estate company with integrated platforms, and we are well within our rights to internalize marketing.”

Posted on

January 3, 2017

by

Fabrizio Zenone

Here's a quick overview:

Real estate was a dominant issue in the Tri-Cities in 2016, with dramatic stories about house prices rising, concerns about affordability, the impact of foreign investment and government intervention.

As early as January, 2016, The Tri-City News reported that homes in some neighbourhoods had risen as much as 20% in value based on assessments, bumping many of them over the million-dollar mark.

The problem, pointed out by realtors, is local residents were being priced out of their own community unless they want to downsize and, with the inventory shrinking for single-family homes and the demand up, prices were expected to continue to rise.

Soon, concerns were being raised about affordability across Metro Vancouver, with numerous fixes proposed, including a housing affordability surcharge. Municipal red tape and development fees were also blamed for high prices, a charge refuted by local mayors, including Coquitlam Mayor Richard Stewart.

The issue of foreign buyers arose in Port Coquitlam with councillors calling for the province to impose a foreign investment tax and some residents complaining that entire neighbourhoods were being bought up for investment leaving homes empty.

The benchmark price for a home in PoCo in April was $846,100, making it one of the most affordable areas in the Lower Mainland. While PoCo council debated the effect of foreign investment on the value of real estate, a city report said the blame doesn't lie with overseas buyers; instead, B.C.'s strong economy, low bank interest rates and good mortgage terms were likely boosting demand.

In Port Moody, the city started looking at how it's going to develop several of its key properties, which include the public works yard, the Kyle Centre site and the property of the former Fire Hall No. 1 as well as what the future holds for the Coronation Park area near Inlet Centre. With the future of the Ioco lands still in question, the city decided to look into options for the David Avenue connector through Bert Flynn Park at the request of a vocal group of residents.

Coquitlam vetted numerous development proposals, especially around the Evergreen Extension, with a public hearing for a 49-storey building next to the new Burquitlam SkyTrain Station. The proponents, Marcon Clarke Homes Ltd. and Kevington Building Corporation, are also proposing to build a 15-storey rental building on the site.

As well, the city is planning for more land development in its visioning process for northwest Burke Mountain, where between 6,500 and 13,500 residents could live in the future.

The real estate industry itself came under fire with concerns about shadow flipping, prompting tighter rules and higher fines to promote transparency. In the summer, the province released figures that showed foreign nationals bought 5.1% of the homes sold in Metro Vancouver in June.

On Aug. 1, the province implemented a 15% foreign buyers tax, with home sales slowing in the fall, partly due to the tax, but because of other fundamentals and government intervention, including the tightening of mortgage rules.

However, in September, The Tri-City News reported that experts were predicting a mild price correction but higher prices over the long term in the region because of a lack of supply. They cited factors such as the limited land base in the Lower Mainland and the projected 1.25 million additional people forecast to come to B.C. by 2041 as the reason for the increased upward pressure on real estate values.

Concerns about the lack of rental accommodations prompted a study of Airbnb rentals in the Tri-Cities, with The News reporting nearly 140 Airbnb listings here, and few were operating with official licenses.

Coquitlam council approved the first purpose-built rental apartment building at Charland Avenue and Blue Mountain Street and announced it had $2.5 million in an affordable housing reserve and was looking for partners.

Meanwhile, for those who found themselves without housing, the Coquitlam homeless shelter at 3030 Gordon Avenue opened in late December, 2015 and by January, 2016, was full.

Posted on

November 15, 2016

by

Fabrizio Zenone

Donald Trump’s shocking upset in the U.S. presidential elections will certainly make waves in the Canadian real estate sector in the near future, although the full economic impact of the mogul’s victory remains to be seen.

In her November 9 column for MoneySense, markets observer Romana King wrote that the results of the U.S. presidential polls might “help suppress any potential mortgage rate increase that was on the horizon.”

“This continued low-rate environment won’t stop the slight uptick in mortgage rates, caused by the recent Federal Liberal mortgage rule changes. However, it may prompt different levels of government to consider alternative methods for cooling heated housing markets,” King said.

“To combat a business contraction, the U.S. Federal Reserve may abandon decisions to start raising interest rates,” she added. “With prolonged low rates from the Feds, it’s unlikely that the Bank of Canada will increase rates, so we can probably expect a prolonged ultra-low rate environment in both Canada and the U.S.”

Meanwhile, Canadians who are contemplating selling their homes might be in for some great times ahead.

“Some [Americans] may be so fed-up that they decide to head north,” Royal LePage CEO Phil Soper said.

Such an influx would benefit urban home owners the most, considering the stronger purchasing power of the greenback compared to the Canadian dollar.

“Home sellers in Vancouver, however, shouldn’t expect a big uptick in American interest, as the Foreign Buyer’s tax that was announced and introduced this past August, will probably dampen interest in property in the Lower Mainland,” King cautioned.

Most importantly, Trump’s apparent preference for an isolationist economic policy that would “tear-up NAFTA” and slap huge taxes on imports originating from China could prove disastrous to Canada.

“In relative terms, trade is much more important to Canada than to the United States. The Americans can afford to be insular since they have 325 million people in their market to our less than 35 million,” King explained. “[It] could prompt lay-offs in certain parts of the country, where exports and trade help shape the local economies. This will impact localized housing markets.”

Posted on

October 13, 2016

by

Fabrizio Zenone

Pricing ranging from 379,900 to 574,900 and will be located at 5460 Broadway, Burnaby.

CONTEMPORARY HOMES

Reflective of Burnaby’s expansive parks and stunning mountains, Seasons showcases the best in West Coast contemporary styling. This limited collection of four-storey residences and townhomes will be coming soon to the vibrant Brentwood neighbourhood.

YOUR NEW NEIGHBOURHOOD

A welcoming community located within the Brentwood neighbourhood in Burnaby. Conveniently connected to a network of bike trails to enjoy leisurely evening rides or everyday commuting. Appreciate an abundance of world-class shops, restaurants, neighbourhood amenities and SkyTrain all within a short walk.

STYLISH & FUNCTIONAL FEATURES

Each home emulates quality, limitless style and comes complete with full-sized, stainless-steel appliances and beautiful fixtures by superior brands.

FLOOR PLANS

Efficient, liveable, open-spaces are ideal for both comfortable living and stylish entertaining.

FEATURES

Premium full-sized, stainless-steel appliances, stylish Kohler fixtures, and quartz countertops are just a few of the impressive list of features available in each home at Seasons.

Posted on

October 13, 2016

by

Fabrizio Zenone

I’d like to address recent media coverage on the challenge of affordable housing in Burnaby, an issue being faced by many communities in B.C.

Make no mistake – creating and preserving affordable housing is, and will continue to be, an absolute priority for this government. We are committed to work in partnership with Burnaby to create more affordable housing in the region, and this commitment is not new.

In late 2015, partners broke ground on a new site for George Derby Manor, where 122 seniors will soon live independently with access to supports and services. This development was possible because of the partnerships between the province, the city and the non-profit provider, the George Derby Society. The B.C. government is arranging approximately $29 million in construction financing for this project.

In 2014, B.C. Housing partnered with private market developer Ledingham McAllister, to replace 90 aging units at Cedar Place – an affordable rental property for families built in 1971. This project will replace existing units and also add 91 new units of seniors’ housing. Current tenants can stay in their homes while the new building is under construction and then move to brand new units once it’s complete.

With support from the city, and in partnership with the private sector, we were able to increase density and provide more housing for those in need. The province will be contributing approximately $33 million for this project.

There are also more affordable units to come. The province recently committed $500 million for affordable rental housing in B.C. We will soon announce projects from municipalities and non-profits across the province that will receive this funding – including some in Burnaby.

Our work in the city is not just about units, however. Last year, we invested over $30 million to provide subsidized housing and rent supplements for approximately 6,800 households in Burnaby. This included seniors, families, people with special needs, those who are homeless or at risk, and women and children fleeing violence.

In addition, the province is prepared to commit funding for a supportive housing development in Burnaby that includes both shelter spaces and transitional housing.

Agencies that serve Burnaby’s homeless population have been advocating for this type of development for some time. We simply ask that the city identify an appropriate piece of land.

I have personally read the City of Burnaby’s housing profile report, and the province is reviewing its recommendations in the context of all provincial housing priorities.

Rest assured, your city is not forgotten.

We will continue to work with the municipality and other partners to find innovative yet pragmatic solutions to the complex issue of housing affordability in B.C.

Rich Coleman, Deputy Premier, Minister Responsible for Housing

Posted on

May 12, 2016

by

fabrizio zenone

Get VIP access , call me now!

|

MODENA IS BURNABY HEIGHTS

As with a much beloved old family recipe, building a home takes the right ingredients, a respect for quality and a genuine passion for the craft. The Citimark and Omicron teams have perfected the balance of luxury and value to create timeless, quality homes that celebrate the authenticity of The Heights.

When it’s time to host a family feast, pop over to Red Apple Market for farm fresh produce and to Regent Fish Market for the daily catch. For a romantic date, pair your favourite wine with goodies from Coiffi’s Meat Market. Rino will set you up with some fabulous authentic handmade pasta, Italian charcuterie, organic poultry, and grass-fed beef. For those moments you’d prefer to leave the preparation to someone else, call in on Theresa at Oui Paris Café, Scott and Stephanie at The Pear Tree Restaurant and Jack at Valley Bakery. Thanks to your new neighbours, effortless entertaining takes on a whole new meaning at Modena.

|

THE NEIGHBOURHOOD YOU ALREADY LOVE

Modena’s neighbourhood is rich with character and community pride. Every element, from the beautifully restored heritage homes to the local shop owners, contributes to the special fabric that is The Heights. Hastings at Madison is the retail core of the community and you’ll find all of your everyday essentials, as well as many special culinary gems, within an easy walk of your home.

Just northeast of Modena is the Eileen Dailly Leisure Pool and Fitness Centre, McGill Library and the beautiful tree-lined Confederation Park. Here you’ll enjoy a walking track, an off-leash dog park, a lawn bowling green, tennis and bocce courts and covered picnic areas with spectacular views of the North Shore Mountains.

|

ns

ns